Do you remember the Maruti’s iconic ad campaign, where a NASA scientist is shown briefing a group of Indian tourists, about the different features of the newly developed rocket for a Jupiter expedition and a seemingly nonchalant Indian guy calls out in hindi asking him ‘Kitna deti hai?’, leaving the scientist stunned? India’s obsession about knowing ‘kitna deti hai’ goes beyond car/bike mileage, and this has been one of the reasons why retail investors have preferred fixed deposits over debt mutual fund due to the latter’s perceived lack of predictable returns. According to a recent analysis[1] by the Reserve Bank of India on households’ financial asset holdings, 53% of these assets are held in bank deposits. To provide context, as of March 2022, households had invested 3.7 lakh crore rupees in debt mutual funds, while a staggering 115 lakh crore rupees were parked in bank deposits, representing a difference of 30 times more in fixed deposits than in debt mutual funds. This is glaring, given that fixed deposits have on an avg. deliver lower post tax returns specially for investors that attract higher marginal tax rate.

So, the issue of debt funds not offering return predictability and FDs not being tax efficient persists. Is there a better option? This issue appears to be resolved by Target Maturity Funds.

What are Target Maturity Funds (TMF)?

These are open-ended passive debt mutual funds that have a defined maturity date. TMFs invest in a portfolio of bonds and hold them until maturity, to provide a reasonably predictable return. It basically combines the benefit of individual bond and a mutual fund.

But how does TMFs provide reasonable return predictability?

Suppose you buy a bond maturing after 6 years, that promises to pay 8% coupon annually and the principal amount at the end of 6th year. If you hold the bond till maturity, your pre-tax returns will be 8%, assuming no reinvestment risk.

TMFs do pretty much the same thing. They buy a portfolio of bonds and hold these bonds until maturity. Partially, as a result of this attribute the TMF segment has seen phenomenal growth in past couple of years. From being non-existent few years back to having more than 70 funds managing ~Rs 1.5Lac Cr, this segment has come a long way.

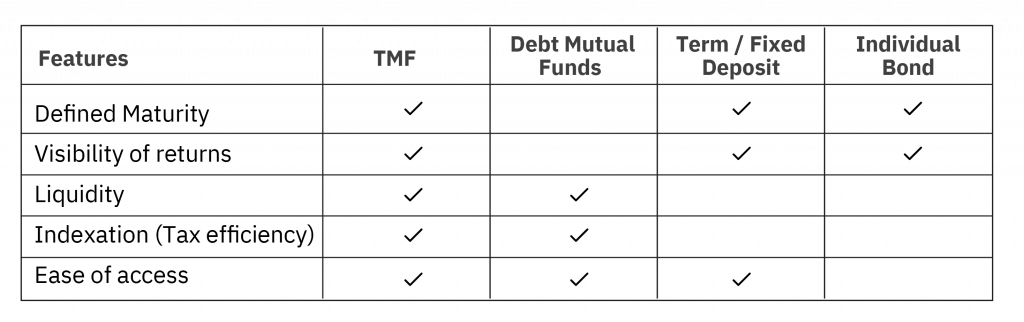

So how does TMFs fare against other similar offerings?

What are key attributes of Target Maturity Funds?

- Liquidity – As these are open-ended funds, they offer investors easy entry/exit. Unlike Fixed Deposit, it doesn’t have any lock-in.

- Returns Visibility – As TMFs invests in bonds that mature just around the fund’s maturity, it offers higher visibility of returns.

- Tax Implication – Like any fixed income / debt mutual funds, TMFs are eligible for indexation benefit for investment period greater than 3 years

How are TMFs tax efficient?

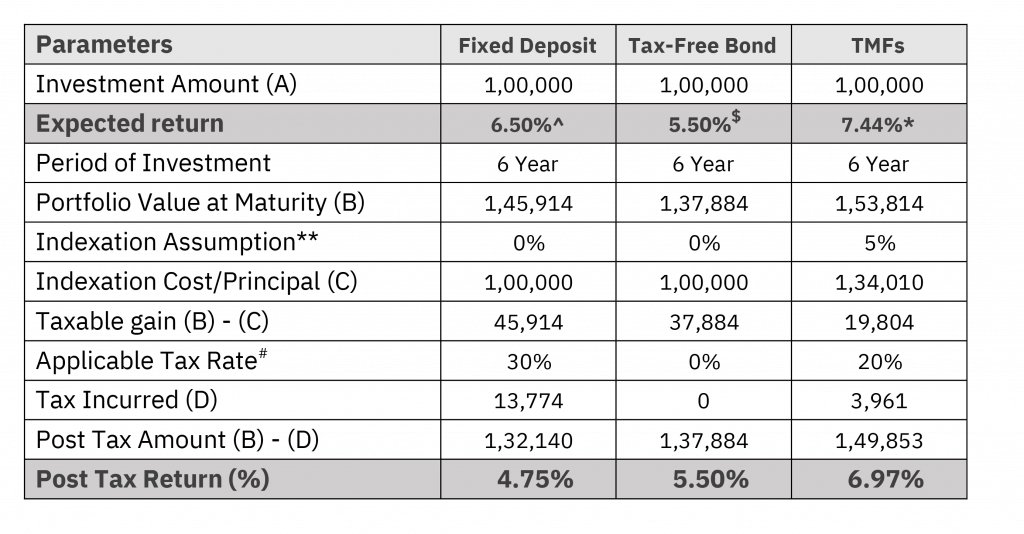

TMFs, like any other debt fund if held for more than 3 years (LTCG) are taxed at 20% with indexation benefit, whereas for period less than 3 years it is taxed at individuals tax slab. A simulation of post-tax returns shows that basis prevalent yields/rate, the TMFs seem to be better alternative to fixed deposits and tax-free bonds.

Source- Data as of 28th Feb, 2023, MOAMC research, ^Fixed Deposit rate as per SBI for maturity greater than 5 years, $ NSE, * YTM , ** 5% per annum indexation assumed; please consult your tax advisor before making any investment decision; #Applicable Tax Rate before surcharge / cess; above table is for illustration purpose to explain the concept may contain accidental omissions

Is it a good time to invest in TMFs?

Central banks worldwide, including the RBI, have resorted to unprecedented rate hikes to contain inflation. From May 2022, the RBI has increased the repo rate by 250 basis points, resulting in a successful reduction of inflation to a manageable level. Hence the market is of the view that the yields may have peaked out with little room for further uptick. As such it may be an opportune time for investors to lock-in their investments at these levels, using a Target maturity fund.

To summarize, Target Maturity Funds seem to have bridged the gap between open ended debt mutual funds and fixed deposits. They provide investors visibility of returns and at the same time are tax efficient. These funds are best suited for an investor seeking high safety, transparency, and whose investment horizon is similar to that of fund maturity.

This article was also featured on CNBC: https://www.cnbctv18.com/business/companies/motilal-oswal-amc-launches-nifty-g-sec-may-2029-index-fund-16130421.htm

Disclaimer: This article has been issued based on internal data, publicly available information and other sources believed to be reliable. The information contained in this document is for general purposes only and not a complete disclosure of every material fact. The indices mentioned herein are for explaining the concept and shall not be construed as investment advice to any party. The information/data herein alone is not sufficient and should not be used for the development or implementation of any investment strategy. It should not be construed as investment advice to any party. All opinions, figures, estimates and data included in this article are as of date. The article does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on our current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Readers shall be fully responsible/liable for any decision taken based on this article. Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.