The Motilal Oswal Global Market Snapshot provides a quick glance at index performances and economy updates from the Indian & global markets.

Click here to view the detailed report for August 2023

Here’s a small preview of the report –

Indian Market Update

- Nifty 50 dropped 2.5% in August due to a slowdown in FPI investment and rising bond yields. However, mid and small caps stole the spotlight by surging 3.9% and 5%, respectively.

- Consumer durables and IT sector led the charge, rising ~4.7 % and 4%, respectively. On the flip side, Energy lagged with a -4.2% decline.

- Factor strategies dipped after a stupendous performance in July. The return of the Low volatility factor dipped slightly more than the other three factors at -1.6%, followed by Enhanced Value at -1.3%.

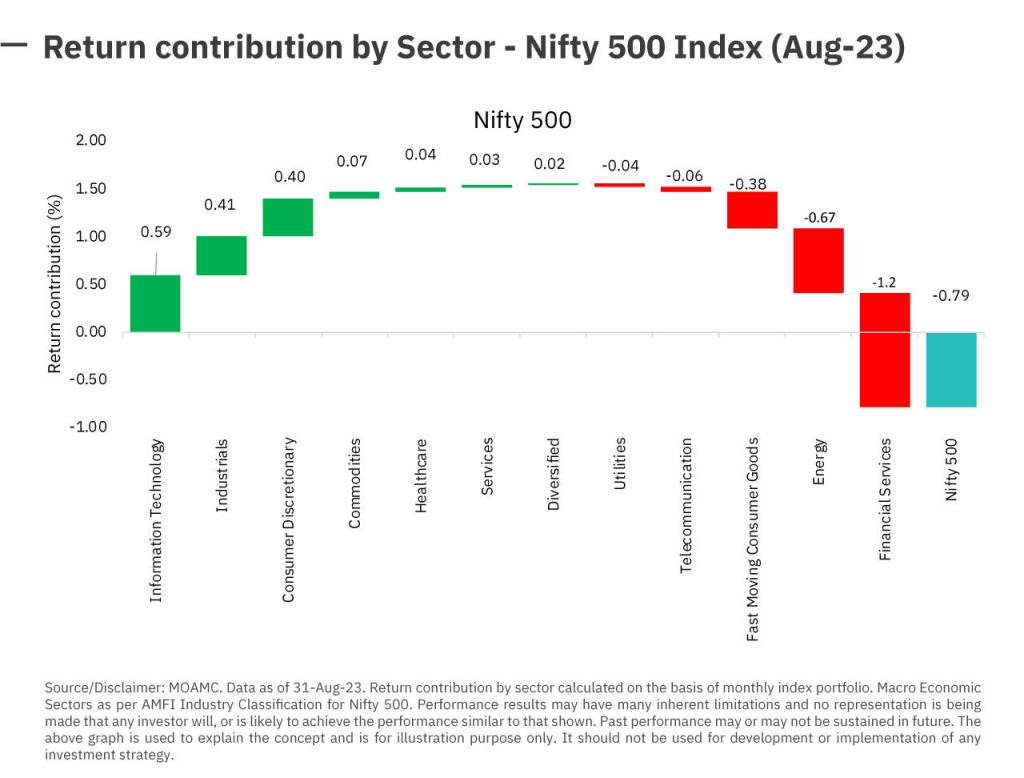

- The financial services sector dragged the overall performance of the Nifty 500, contributing -1.2% to the overall return. IT sector provided support by contributing a positive 0.6% to Nifty 500.

Global Market Update

- Both Emerging and Developed markets fell in cohesion, with South Africa falling -12.3%, followed by Brazil and China at -9% each.

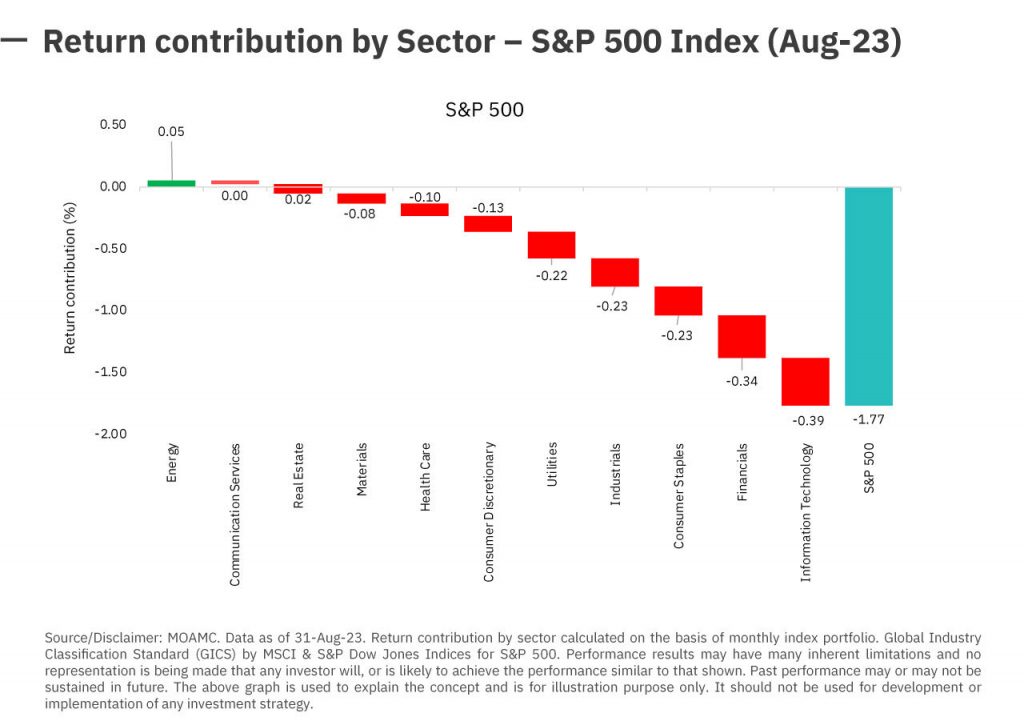

- Within the US market, the NASDAQ 100 and S&P 500 indices fell -1.6% & -1.7%, respectively. IT sector contributed -0.39% to the overall fall of -1.7% of S&P 500.

- On the commodities side, the oil prices recorded yet another positive month and rose 2.2%, but on a year-on-year basis, oil prices are down -8%, providing respite to consumers. Silver & gold prices diverged a bit as silver prices remained flat for the month while gold prices fell -1.4%.

- Crypto currency’s downward trend continued, as Bitcoin & Ethereum prices crashed a massive -11% each in August.

Economic Indicators

- India’s retail Inflation surged to a 15-month high of 7.44% in July on account of a spike in food prices; however, the seasonal impact on food prices is expected to withdraw in coming months.

- India’s composite PMI continues to stay in expansion territory at 60.9, with the services PMI and manufacturing PMI at 60.1 and 58.6, respectively. (reading >50 indicates expansion)

- In the US, the inflation rate has fallen to a third from its peak of 9% in June 2022, now standing at 3.2% in July 2023.

“It is not prudent to attempt to switch and swap asset classes based on short-term market predictions.” – Richard A. Ferri