Did you know that there’s a significant financial index in India that captures the pulse of 500 top-performing companies? It’s not the Nifty 50, which is frequently discussed in financial circles, but a broader, more comprehensive index known as the Nifty 500.

This index offers a vivid snapshot of the Indian corporate sector, encompassing varied sectors and industries. For those keen on understanding the Indian market’s depth and diversity, the Nifty 500 offers a goldmine of information.

Keep reading to find out the significance for investors.

Key Takeaways about the Nifty 500 Index:

- Representing the performance of the top 500 companies based on market capitalization listed on the National Stock Exchange, the Nifty 500 provides a blanket view of India’s stock market health.

- From IT to the pharmaceuticals, and from the banking sector to the real estate market, it touches every corner. Its diverse nature ensures resilience, even if one sector faces challenges.

- Given its wide coverage, the Nifty 500 Index stands out as a prime choice for passive investment strategies. Those looking to mirror the index’s performance can access a significant portion of the Indian equity landscape, thereby diluting the risks of single-stock investments.

What is Nifty 500 Index?

The Nifty 500 Index, as the name suggests, is a stock market index that comprises the top 500 companies based on market capitalization listed on the National Stock Exchange (NSE) of India. It acts as a barometer of the Indian stock market’s overall performance, including both large-cap and mid-cap companies, hence ensuring a broad representation.

The Nifty 500 serves as an excellent tool for passive investment strategies, where investors aim to replicate the index’s performance rather than handpick individual stocks. It reduces the risk associated with single-stock investments and provides diversified exposure to the Indian equity market.

An interesting fact to note about the influence and size of the Nifty 500 index is seen in the performance of specific funds tied to it. For example, The Motilal Oswal Nifty 500 Index Fund – Regular Plan currently holds Assets under Management worth Rs 508.63 crore as of July 31, 2023.

Understanding the Nifty 500 Index is essential for anyone interested in the Indian stock market’s landscape. It provides a broad, in-depth view, making it invaluable for both amateur and seasoned investors.

Which Companies Make Up the Nifty 500 Index?

“What is Nifty 500 Index?”, you ask. Well, it is essential to highlight its composition. The Nifty 500 Index signifies the combined might of the top 500 companies listed on the National Stock Exchange (NSE) of India.

The list of companies can change based on their market capitalisation and other criteria set by the NSE. Periodic reviews are conducted to ensure the index remains relevant and truly represents the Indian equity market’s dynamism.

To give a clearer picture without naming specific companies, let’s consider a hypothetical scenario. Company A, a leading tech firm with a significant market share and influence in its sector, would likely find a place in the index.

On the other hand, Company B, a small start-up still finding its feet, would not be part of the Nifty 500 until it grows in size and influence.

How Nifty 500 Index is Calculated

For anyone sailing into the financial world of India, understanding indices like the Nifty 500 is a must. Let us help you understand a little more. When one inquires, “What is Nifty 500 Index?”, it’s not just about the companies it comprises but also the meticulous methodology behind its calculation.

Here’s a breakdown:

Methodology behind the index calculation

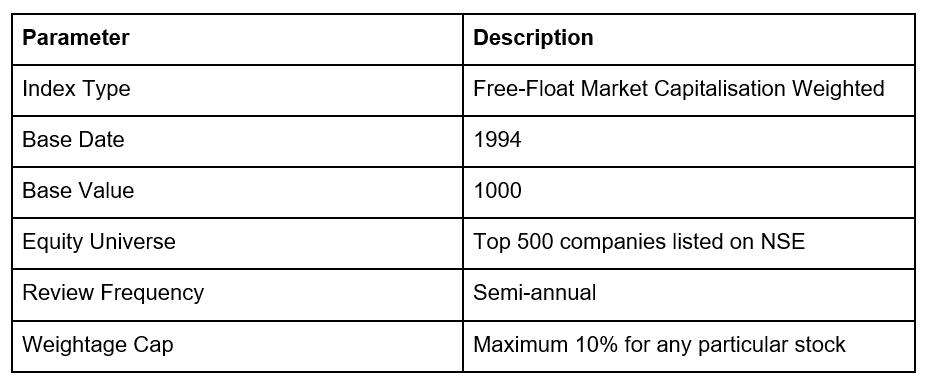

The computation of the Nifty 500 Index is based on the free-float market capitalization approach. In this method, the index’s value represents the collective market worth of its constituent stocks compared to a specific reference timeframe.

Here’s a tabular representation for clarity:

Performance Analysis

To understand India’s economic health and stock market direction, it is vital to look at the Nifty 500 Index’s performance. By assessing its performance, we can get insights into the overall economic health of the country and predict where the stock market might be headed.

It serves as a crucial barometer for investors, policymakers, and analysts to understand current market dynamics and prospects.

Let’s dive deeper:

Historical performance trends

From the moment the Nifty 500 Index was introduced, it has been a roller-coaster ride, mirroring the numerous ebbs and flows of India’s economic landscape.

The index has not only been influenced by domestic factors but also by global happenings that have shaped investment sentiments worldwide.

In periods when the market sentiment was positive and investor confidence was high, the Nifty 500 Index surged, reflecting the optimistic outlook of the Indian equity market. This upward trajectory is usually characterized by strong corporate earnings, encouraging economic indicators, and positive policy reforms.

Conversely, during pessimistic market phases, the index has experienced declines. These downward movements can be attributed to a variety of factors, including domestic economic challenges, policy roadblocks, or international events that send ripples through global markets.

Major milestones reached by the index

Over the years, the Nifty 500 Index has reached several milestones. For example, after starting at a base value of 1000 in 1994, it touched the 5000 mark in the early 2000s, indicating the robust growth of the Indian equity market.

Another significant milestone was when it crossed the 10,000 mark, reflecting heightened investor confidence and robust economic growth.

Understanding the calculation and performance analysis of the Nifty 500 Index is crucial for both seasoned investors and financial enthusiasts. It’s a testament to India’s ever-evolving economic landscape.

Investment Opportunities

The Indian stock market offers a plethora of investment avenues for both the cautious and the adventurous. Amidst this varied and vast landscape, the Nifty 500 Index emerges as an emblem of reliability and comprehensive market representation.

As we mentioned before, ‘Nifty 500 Index’ is the combined might of the top 500 companies listed on the National Stock Exchange (NSE) of India, making it an attractive proposition for varied investment strategies. How, you ask?

Here’s a closer look:

ETFs and Mutual Funds based on Nifty 500

Exchange Traded Funds (ETFs) and Mutual Funds that track the Nifty 500 provide investors with an opportunity to invest in a broad spectrum of Indian companies without the need to buy each stock individually.

These financial instruments mimic the performance of the index, ensuring that investors benefit from the overall growth of the top 500 companies.

Benefits of investing in Nifty 500-related instruments

1. Diversification: Instead of placing all bets on a single stock, investing in Nifty 500 instruments ensures a spread across sectors and industries, reducing risk.

2. Performance Tracking: Since these instruments mirror the Nifty 500, tracking market performance becomes more straightforward.

3. Cost-Effective: Building a portfolio resembling the Nifty 500 individually can be costly. These instruments offer a more affordable route.

4. Professional Management: Mutual Funds provide the added advantage of professional portfolio management, optimizing returns.

Why is the Nifty 500 Index So Crucial in Financial Markets?

To a newbie, indices might seem like mere numbers. But in the world of finance, they’re much more. They narrate stories, indicate economic health, and hint at future trends. And among them, the Nifty 500 Index holds a paramount position.

Here’s why:

- It represents approximately 95% of the total market capitalisation, making it an excellent indicator of the overall market sentiment.

- A comprehensive blend of various sectors ensures a holistic view of the market.

- For foreign investors, it serves as a benchmark to gauge the health of the Indian economy.

- It aids in the creation of diverse financial products like ETFs and Mutual Funds.

- By encompassing small, medium, and large-cap stocks, it captures varied market dynamics.

- It offers insights into the performance of leading Indian companies across industries.

- The semi-annual review ensures that only relevant companies feature in the index, ensuring its quality.

Final Thoughts

As Warren Buffet wisely said, “Do not put all your eggs in one basket.”

The Nifty 500 Index epitomizes this wisdom by offering a diversified investment avenue reflecting the broader market. If you’re looking to anchor your investments in the vibrant yet volatile world of Indian stocks, consider the Nifty 500.

Time to invest and diversify your portfolio!

Disclaimer: This blog has been issued on the basis of internal data, publicly available information and other sources believed to be reliable. The information contained in this document is for general purposes only and not a complete disclosure of every material fact. The information/data herein alone is not sufficient and shouldn’t be used for the development or implementation of an investment strategy. It should not be construed as investment advice to any party. All opinions, figures, estimates and data included in this blog are as on date. The blog does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on our current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statement. Readers shall be fully responsible/liable for any decision taken on the basis of this article.

The sector mentioned herein are for general assesment purpose only and not a complete disclosure of every material fact. It should not be construed as investment advice to any party. Past performance may or may not be sustained in future.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.