Dear investor

Wish you all a Very Happy New Year

At this juncture, let us briefly look at what happened last year and try to create a thesis of what may work in the new year.

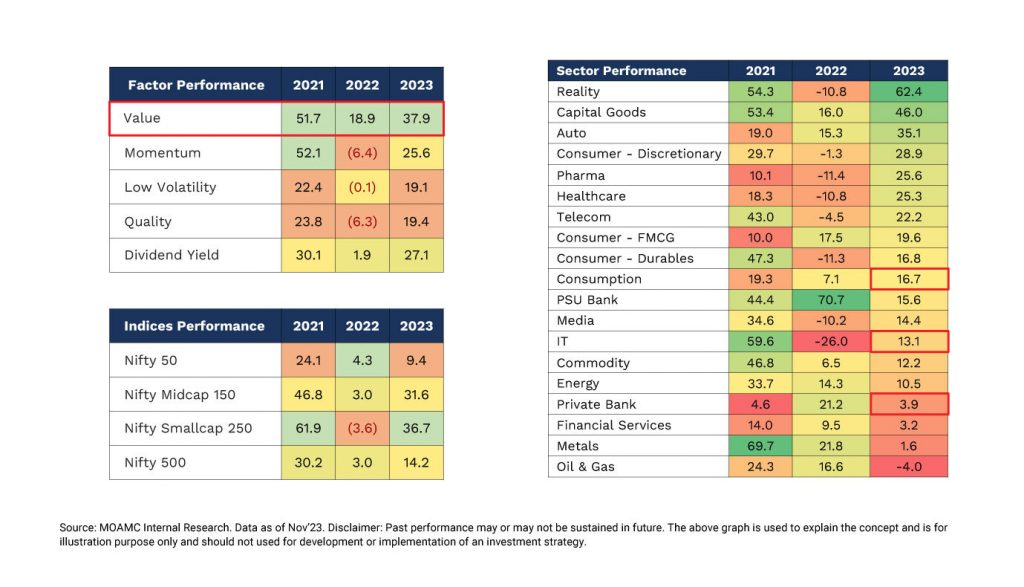

Calendar 2023 continued to be the year of value style of investing. This has been the case for the last 3 years when the beaten down spaces have come back strongly on sustained government support. If we look at some of the strongest performers of 2023, they belonged to the PSU space in sectors like power ecosystem which includes producers like NTPC and Neyvelli Lignite, financiers like PFC and REC and new listing like IREDA and equipment makers like BHEL and commodity input producers like Coal India. Metal ecosystem also did well with both PSU and private companies doing well. PSUs in defence space saw a strong momentum across the board. Many of these spaces still retain value and are benefitted positively by the reform agenda and still offer value. Some, like BHEL, are re-inventing themselves. These spaces could hence continue to do well this year.

Calendar 2023 was also a year when the high growth companies found their footing back. High growth as an investing style came back into focus as interest rates stopped increasing and visibility of growth became stronger. Companies in the new tech space, midcap IT services companies, hospitals, retail oriented banks with strong AUM growth, engineering companies, luxury consumption, Electric vehicles, renewable energy, etc did very well. The growth delivered by the broad market was much stronger than the growth of the businesses in the narrow large cap indices, like Nifty, and broader market did very well.

In 2023, two large spaces did not perform very well in the Index. These are larger private banks and IT services companies. We were saying continuously in 2023, that it is time for Alpha because we could take money from these spaces and invest into other spaces where growth trajectory was higher.

Highest quality space such as consumers did not perform well. We believe that the period we are in (from 2021) is seeing the highest growth in earnings that market has seen from early 2000s and in this manner this period is different from other past periods. In the high quality high growth space, companies providing high growth quotient should be expected to continue to do well and this is where our funds are positioned.

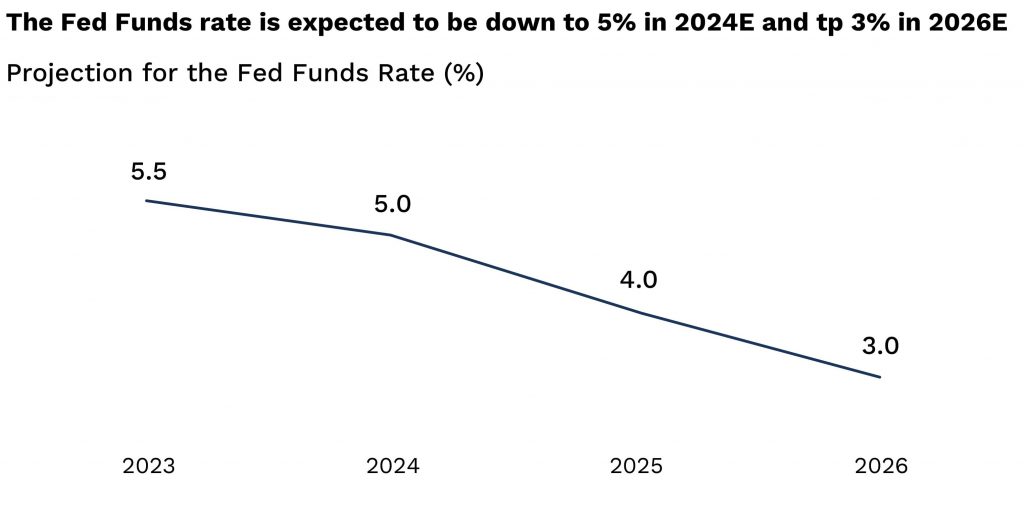

The macro scenario underwent large changes during the year. There was uncertainty caused by the Israel-Hamas war while the Russia-Ukraine war continued. US and our country continued to see central banks increase interest rates and higher for longer became the dominant thought. Bond yields in the US climbed to 5% and all associated risks came to fore. Oil prices spiked twice to over USD90 levels. However, many of these stresses got addressed as time went by. Oil prices have declined to sub USD80/bbl. Bond yields in the US have declined from 5% (for 10year bonds) to below 4%. The outcomes of the state elections in 2023 have reduced the uncertainty around the 2024 general elections.

Outlook going forward

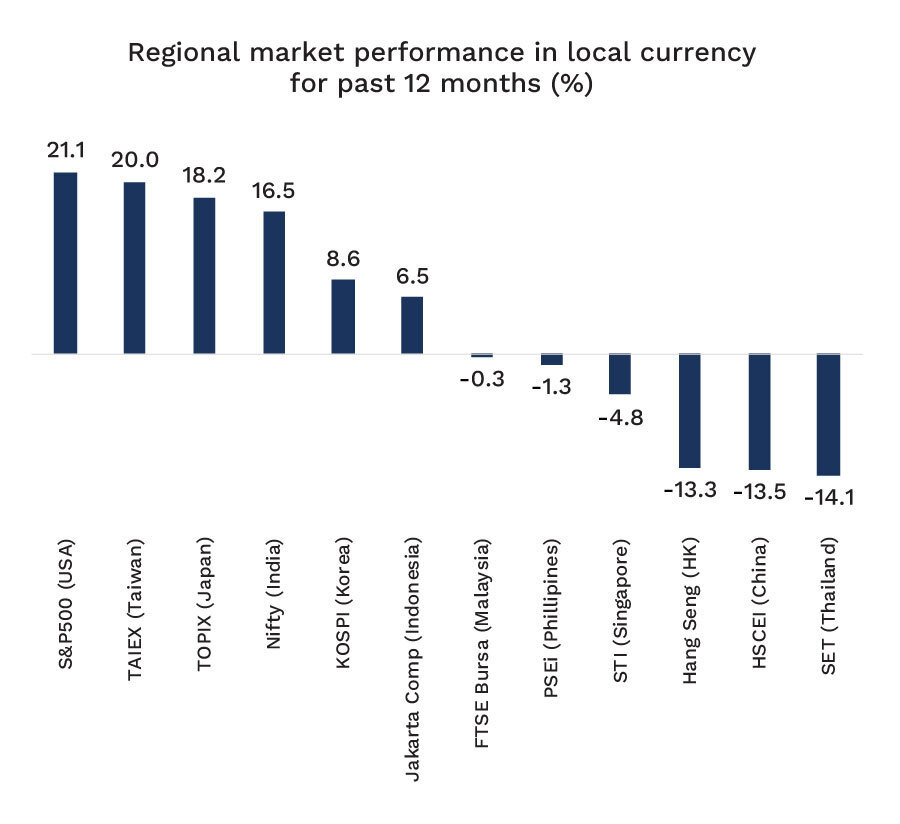

Indian markets offer diversification benefit to global investors and performance has been very divergent

While India has been one of the better performing markets of 2023, the performance has the backing of good earnings momentum and good macro outlook vs many other countries in the world. With domestic money, coming into the markets through SIPS in a structural manner, now being the key driver of the market, our markets are offering diversification benefits to global investors. Depth has also improved considerably.

Going forward, we believe that each global market would increasingly be driven by its own internals and influence of global factors could reduce. For growth investors, as yet, no other market offers the potential and choice that Indian market offers.

Outlook on Valuations

We have a positive construct on the market going forward. Reform momentum remains strong and so is the earnings momentum. After a long while, we have seen future earnings estimates hold, as the year progressed. Valuations, as yet are just about long period averages.

Given the sharp change in the outlook over the past one month, as described earlier, unless some of the factors reverse sharply, we believe that this period should be a period when markets sustain higher than average valuations for a length of time.

Outlook on Flows

Outlook on money flow has improved. FPIs have tracked the election outcomes and are more confident. Moreover, as US yields drop, there is a good chance of improved inflows into EM market and India funds. Already, December has seen strong FPI inflows. Since FPI flows are chunky, they tend to favour the larger cap part of the market.

Domestic flows should continue to remain strong. We believe that domestic investor is underinvested into equities and with rising per-capita incomes, should continue to invest in a structural manner. SIP seems to be the chosen instrument to invest. For market followers, SIP flows are very predictable and are rising strongly. Domestic Investors seem to be favoring the performing part of the market. Small and Mid part of the market is seeing strong earnings growth and stock price performance and is now getting a larger part of domestic flows.

Overall, hence, we believe that outlook on money flow into markets in the new year is good. However, at the same time, new issuance calendar is also getting stiffer and this provides a safety valve.

It continues to be time for alpha

Our strong belief is that the market performance follows earnings performance. If we look at the long period earnings move of the large, mid and small cap part of the market, we see that the current period is unlike any period since early 2000s. In the early part of the century, growth was strong but was more evenly distributed between large, mid and small cap parts. In the 2008 to 2021 period, on account of several disruptions like Lehman, bank loss recognition, ILFS, Covid, etc, larger caps delivered small 5% earnings growth while Midcaps delivered just about 4% and small caps delivered just about 3%. Highest quality businesses did well on account of presence of cash on books while inability to borrow constrained growth in other parts of the economy. Onward march of globalization made it very difficult for domestic Indian businesses to thrive, particularly in the manufacturing space.

From the bottom of Covid China + 1 sentiment has gained ground globally and helped with government support, whole new ecosystem of manufacturing businesses is coming up. This is resulting in midcaps delivering higher growth than larger caps and small caps delivering the highest growth quotient. Many of the investing themes are more present in the mid and small part of the market vs the larger part of the market.

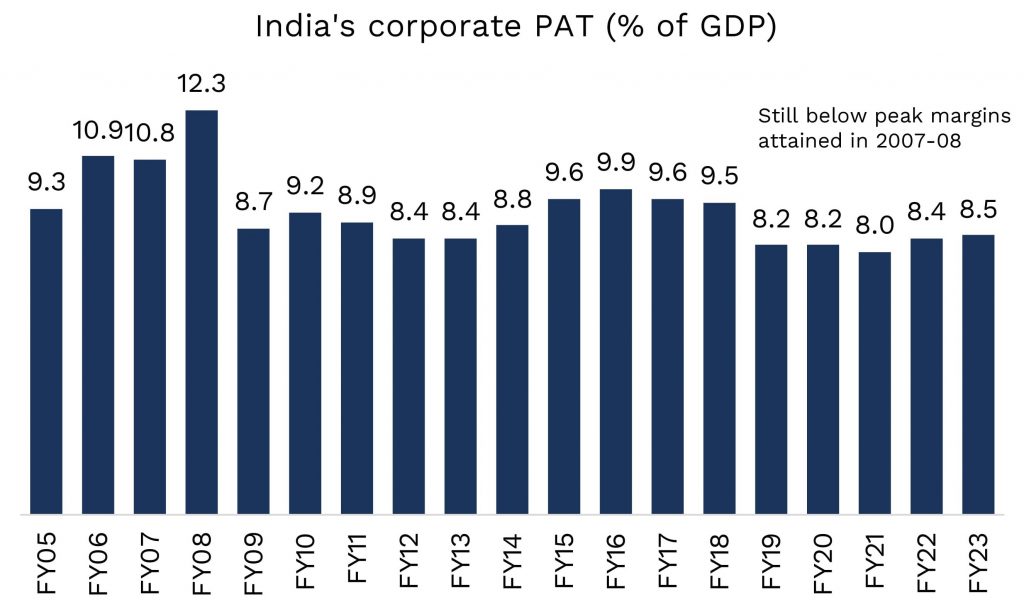

Margins could expand as Inflation has fallen. 2023 has been the story of better margins and this could continue into 2024 as we are still below peak margins attained in 2007 (profit as a percentage of GDP) while policy direction is much more conducive.

Given the higher growth tailwinds, the stock market performance may remain stronger in the mid and small part of the market.

2024 seems to be a year which holds a lot of promise amid continuity in policy direction. Reduction in interest rates over the year should result in growth as an investment style, slowly gaining prominence.

CY24 could continue to see many of the same spaces perform strongly for growth investors

- 1)Private sector capex could start to strengthen.

- Driver 1: housing where unsold inventory has fallen to lowest in a decade and warrants new launches.

- Driver 2: Demand and Supply gap for Cement and Steel, two largest drivers of capex, and also power given the large peak power deficit, should kick-start industrial capex.

- Lower corporate leverage and buoyant cash flows support the capex

- Validation: The buoyancy seen in bank sanctions towards private sector points to improved capex outlook

In the capex space, a good way to address the space would be to be exposed to the players who are diversified or whose products go into a diverse range of applications or are exposed to the strongest growth spaces. This would improve the predictability of the revenue and profit streams. On this count

- We believe large MNC/ domestic engineering cos could be one way to benefit as they are diversified. MNCs can bring cutting edge solutions from their parent for satisfying Next Trillion Dollar needs of the country. On the domestic side, we focus on managements with strong ability to seize opportunities coming their way and who could craft a growth path which may be very different from the current business. In this space it is clear that MNCs are gaining market share and way out for domestic players is to diversify into newer spaces.

- Power Cable companies could be offering a cheaper way of benefitting from the same. Cables go into a wide spectrum of capex spends and hence offer much more steadier growth.

- Renewable energy players in verticals like wind, pump storage, could experience strong growth. Even coal based power producers might see strong order momentum.

- Import substitution is a big driver of growth as the government is able to provide protection with globalisation reversing.

- In this space defence might continue to show traction given the geopolitics.

- MNCs are investing strongly into newer factories and that is good for job creation. However, this space is largely unlisted.

While capex may continue with private sector taking the baton from the government in terms of growth driver, consumption could continue to lose market share as a percentage of GDP. This is because fiscal consolidation to 4.5% fiscal deficit would imply lower growth in government spending, including capex. An interesting trend is being seen. Savings bank accounts are seeing a deceleration in growth. Consumption is funded by withdrawal from these accounts. This coupled with the slowdown in personal loan growth on central bank intervention should result in small ticket private consumption and even larger ticket wedding related spends for example, to deliver muted growth. Lower job growth in tech services space is also a dampener. Faster growth categories in consumption such as cell phones and other electronics are not represented in the markets. However, elections have always resulted in expansion in money supply and it should help this year as well. Moreover, there is wealth effect on account of better equity, gold and property prices. We are invested into small spaces in consumption which are growing strongly such as:

- Food delivery companies. This category continues to show strong growth.

- Luxury consumption categories such as hotels, luxury malls, jewellery companies, etc

- Electronics retail to benefit from fast growth in electronics sales.

Large Banks and IT services have not performed in 2023 and this trend can continue into the new year. This is because, a cut in central bank rates in the west may be seen as evidence of slowdown of the economy which would again constrain tech investments. Large banks would face margin headwinds as interest rates decline and also as lending picks up for lower margin corporate loans. However, both these spaces may benefit from any strong FPI inflows as cuts in interest rates would make growth assets like Indian equities more attractive.

Overall, a very interesting year ahead. There is a great chance that both styles of investing, Value and Growth, do well this year with growth style gradually finding better traction as interest rates decline. We continue to believe that market would follow earnings growth and are invested in some of the fastest growth in earnings spaces.

On this note, wish everyone a Very Happy New Year. Happy investing

Thanks and Regards

Prateek Agrawal

Executive DIrector Motilal Oswal Asset Management Company