The Motilal Oswal Global Market Snapshot provides a quick glance at index performances and economy updates from the Indian & global markets.

Click here to view the detailed report for December 2023

Indian Market Update

- In December 2023, the Indian stock markets experienced a notable upturn, as evidenced by a ~8 % surge in the Nifty 50 index. The Nifty Next 50 index outperformed, leading the gains with an impressive growth of ~11%.

- Across the board, all sector indices closed the month on a positive note. The energy sector emerged as the top performer, witnessing a substantial increase of ~14%.

- Factor-based investment strategies, including Momentum, Low Volatility, Quality, and Value, all delivered positive returns for December. Value factor emerged as the frontrunner, registering the highest rise at ~13% during the month and Quality factor also witnessed an increase of ~11%.

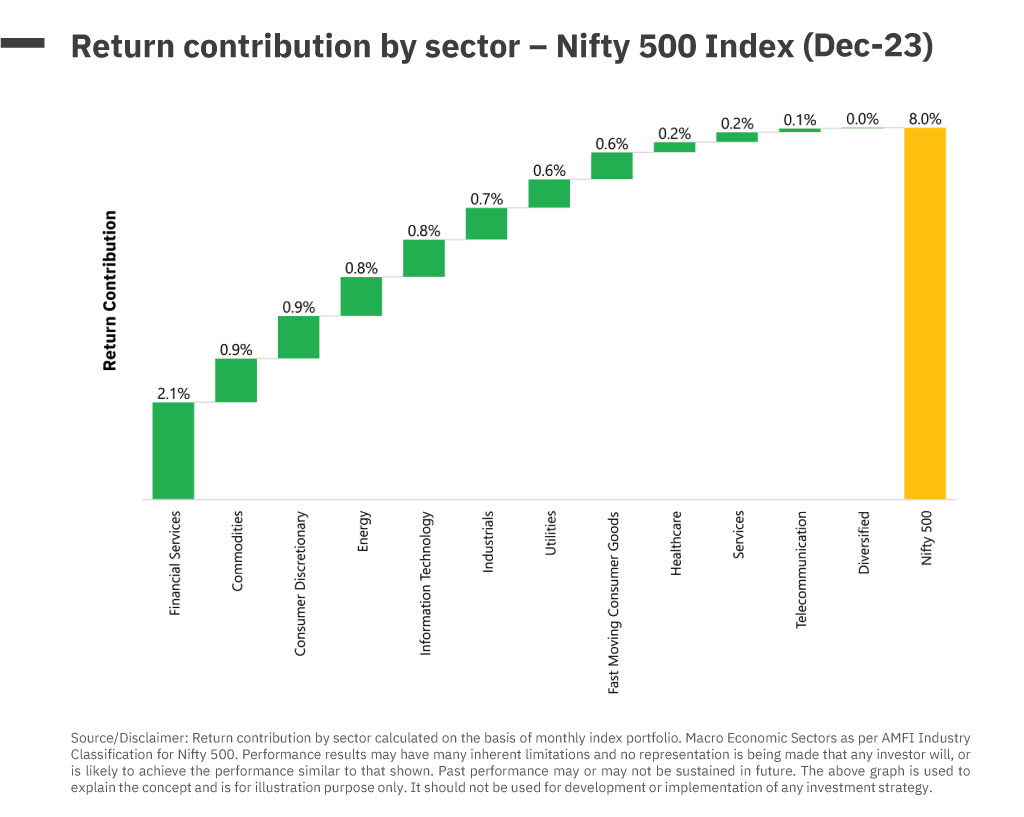

- The Financial Services sector continued to play a pivotal role in propelling the Nifty 500 index, contributing 2.1% to the overall 8% increase in Nifty 500 during December 2023.

Global Market Update

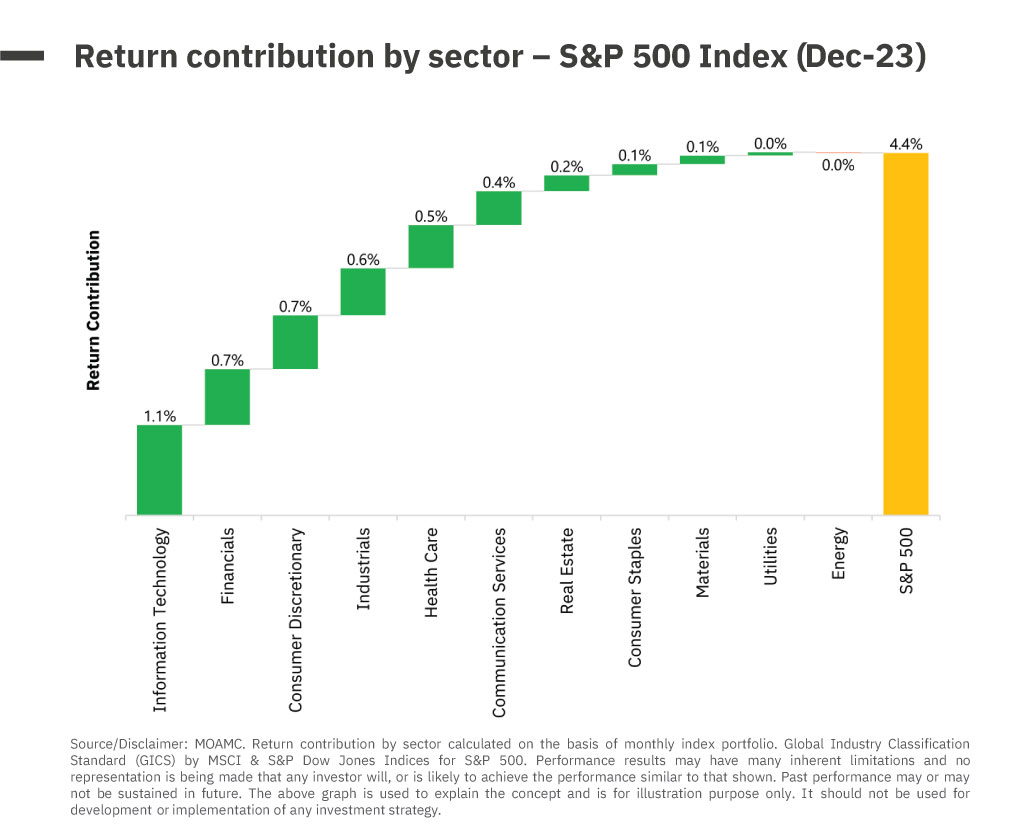

- In the US, S&P 500 and NASDAQ 100 both experienced a ~4% & ~5% gains in December 2023 respectively, with the Information Technology sector being the largest contributor to the S&P 500’s rise.

- Globally, both emerging and developed markets saw positive performance, with an exception to China which shown a negative ~2.5%. Brazil, South Africa and Korea, witnessed an increase of 6% in December 2023.

- Crude oil prices nosedived by ~6% during December due to rising geo-political risks, low demand from the US and mixed Chinese data.

- On the commodities front, gold prices witnessed a rise of ~2% and silver saw a decline of ~5%, amid rising tensions in the middle east. Cryptocurrencies like Bitcoin and Ethereum went soaring at 12% and 11%, respectively.

Economic Indicators

- India’s retail inflation has risen to 5.55% in November, mainly due to food inflation from 4.87% in October.

- GST collections in the month of December stands at Rs 1.64 lakh crores. Notably, this marks the seventh month so far this year with collections exceeding by ~ Rs 1.60 lakh crore.

- At the recent FOMC meeting, the Federal Reserve maintained interest rates at 5.50%, showing confidence in the US economy.

- In the month of December, US 10-year Treasury yields fell to 3.88% from the earlier 4.36% in November.