The appetite for international investing has surged in India over the last few years. With India representing ~3% of the world’s GDP and global market capitalization, the average investor is now exploring opportunities outside India. US-focused funds have seen strong traction as US equity markets outperformed over the last decade led by tech giants. Other Developed Markets, which represent ~28% of the global market cap, remain largely unexplored.

What are Developed Markets?

Economically advanced countries with a high standard of living and mature capital markets are collectively called Developed Markets. They have access to a large pool of highly skilled human capital and significant economic capital. These markets also have robust regulatory frameworks and provide financial and political stability, allowing businesses to flourish. By way of broad-based index that measures performance of developed markets, MSCI coined the term ‘EAFE’ that stands for Europe, Australasia, and Far East and covers 21 Developed Markets, excluding the US and Canada.

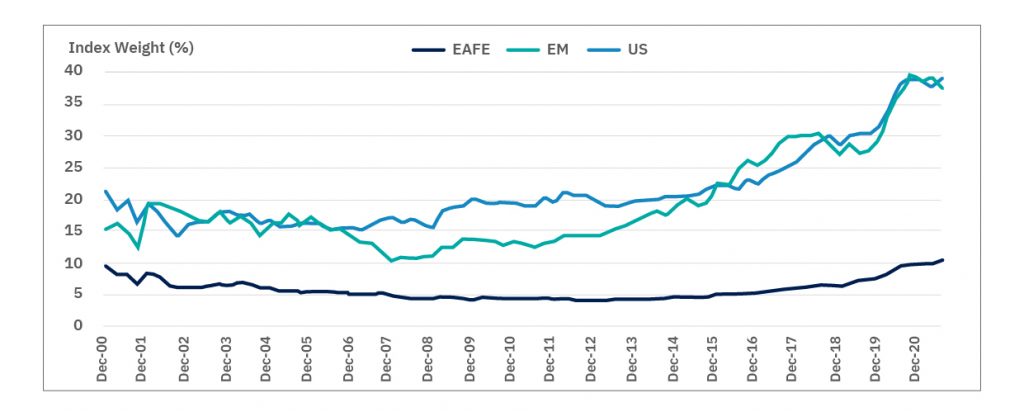

With a low correlation of just 42% with Nifty 500 and 57% with S&P 500, ‘EAFE’ offers Indian investors the opportunity to diversify across geographies and reduce country-specific risk in their portfolios. The weight of tech stocks in the US and Emerging Market indices have steadily increased from ~15-20% in the early 2000s to ~35-40% today. However, EAFE’s exposure to tech has remained relatively stable at ~10%, offering investors a unique sector-level diversification that may help reduce volatility in the long run.

Exhibit 1 – Weight of Tech stocks in the Index

Source: Why International Equities (lazardassetmanagement.com), June-2021; Weights are end of period classification using GICS level 3 and GICS Level 1. The above graph is used to explain the concept and is for illustration purpose only and should not be used for development or implementation of an investment strategy. Past performance may or may not be sustained in future.

How to add Developed Markets to your portfolio?

Motilal Oswal MSCI EAFE Top 100 Select Index Fund invests in the companies that are part of the MSCI EAFE Top 100 Select Index. The index represents the top 100 companies that are selected from the 10 largest Developed Markets from MSCI EAFE Index (Parent index). This fund can provide investors an easy, effective, and economical way to get exposure to a representative slice of Developed Markets.

Key attributes of Motilal Oswal MSCI EAFE Top 100 Select Index Fund –

- Provides exposure to the 10 largest Developed Markets, excluding US and Canada

- Low correlation of underlying index to Indian Equity

- Provides exposure to renowned global brands

- Well diversified across stock, sector, and geography

- Benefit from INR depreciation

MSCI EAFE Top 100 Select Index is also home to some of the world’s largest brands outside tech, including household names like Nestle, Sony, Unilever, L’Oréal, Toyota, and many more. Most of these companies have operations around the world, deriving significant revenue from outside their home country. Therefore, their growth and profitability are not affected by how well their home country’s economy performs.

Exhibit 2 – Brands from Developed Markets

Source: MSCI; Data as of Oct 31, 2021; The Stocks mentioned above are used to explain the concept and is for illustration purpose only and should not be used for development or implementation of an investment strategy. It should not be construed as investment advice to any party. The stocks may or may not be part of our portfolio/strategy/ schemes.

Conclusion

This fund forms an integral part in Motilal Oswal Asset Management Company’s endeavour to provide Indian investors with building blocks to construct a global portfolio. Given the unique exposure offered by Motilal Oswal MSCI EAFE Top 100 Select Index Fund, investors may benefit from adding it to their international portfolio in combination with US Equity. This can help to improve the geographical, sectoral, and stock-level diversification.

Disclaimer: This article has been issued on the basis of internal data, publicly available information and other sources believed to be reliable. The information contained in this document is for general purposes only and not a complete disclosure of every material fact. The indices mentioned herein is for explaining the concept and shall not be construed as an investment advice to any party. The information / data herein alone is not sufficient and should not be used for the development or implementation of any investment strategy. It should not be construed as an investment advice to any party. All opinions, figures, estimates and data included in this article are as on date. The article does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on our current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Readers shall be fully responsible/liable for any decision taken on the basis of this article. Mutual Fund investments are subject to market risks, read all scheme related documents carefully.