Imagine walking into an ice cream parlor with tens of flavors to offer. Standing in front of the frosted ice cream display counter, you would have the hardest time choosing from 20+ flavors, and you would eventually be drawn to your always go-to flavor. Similarly, when it comes to investing, investors tend to prefer investing in domestic markets over international markets due to familiarity. In investing terminology, it is often known as ‘Home Bias’. According to a study , Indian investment portfolios have been over 99% (tad shy of 100% mark) invested in domestic assets, showcasing a strong home bias. The magnitude of home bias shown by Indian investors is one of the highest across countries.

Why do investors exhibit a strong home bias?

Investors may shy away from investing in the overseas market due to the following reasons:

1. Lack of Information – Unfamiliar companies/business models/industry

2. Regulatory hurdles – Investing in overseas market may be complicated and subject to various regulatory hurdles

3. Higher transaction cost- investing in a few markets may entail higher which may act as a deterrent

4. Country specific risk – International investing exposes investors to country-specific risks like political and legal risks

5. Economic growth used to predict equity market growth- Investors use the country’s economic growth as a predictor of equity market growth, particularly investors from high growth economies.

The introduction of overseas mutual funds resolved most issues, except for the investor’s belief that higher economic growth equals better equity returns.

What investors miss out due to home bias?

1. 97% opportunities lie outside India

Investing primarily in the domestic market restricts investors to a limited investment opportunity, representing only 3% of the global market capitalization, thus missing out on 97% of the potential investment options available internationally.

2. Small subset

Out of the top 500 companies globally based on revenue, only a limited number come from India and other high-growth economies. While companies in these countries have recently gained recognition on a global scale, they tend to be much smaller in size compared to their international peers. For instance, only 9 Indian companies have made it onto the list of the top 500 global companies.

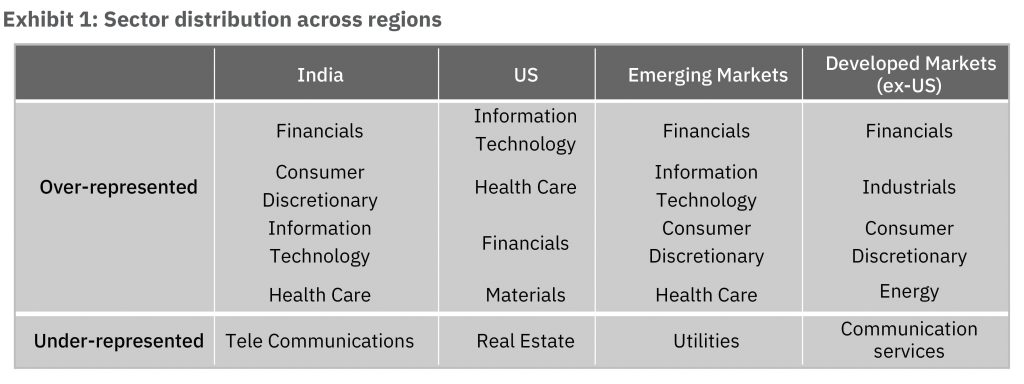

3. Sector representation

An analysis of the distribution of domestic equity sectors reveals an over-concentration in Financials, IT, and Consumer Goods and a lack of representation in sectors like Health Care, Telecommunications Services, and Utilities. For the markets to keep doing well in the future, the overrepresented sectors must keep doing well, which brings in significant sector risk. So, it bodes well for investors to broaden their sector exposure by investing across geographies that are over/underweight different sectors.

A casual observation of the exhibit suggests that the sector composition appears to be similar across markets. However, it is important to recognize that the companies comprising these sectors are not identical. The companies vary in their business models, revenue structures, and growth prospects. For example, while both India and the US have a considerable presence of the IT sector, the companies in each market differ greatly. India has a higher presence of solution-based companies, while the US is home to consumer-oriented tech companies and those involved in hard technology.

By not limiting the portfolio to geographical boundaries, an investor would get varied sector and business exposure and thereby reduce his risk.

Benefits of International Investing

1. Diversification –

In the past, domestic markets have shown lower correlation with international markets, indicating that they react differently to market and economic events. Diversifying into different markets provides a more well-rounded portfolio that can better withstand market shocks during a downturn. Additionally, having exposure to multiple markets helps an investor avoid panic selling and maintain their investment strategy.

It is critical to note that the basic premise of diversification is to ‘reduce risk’ and not ‘enhance return’.

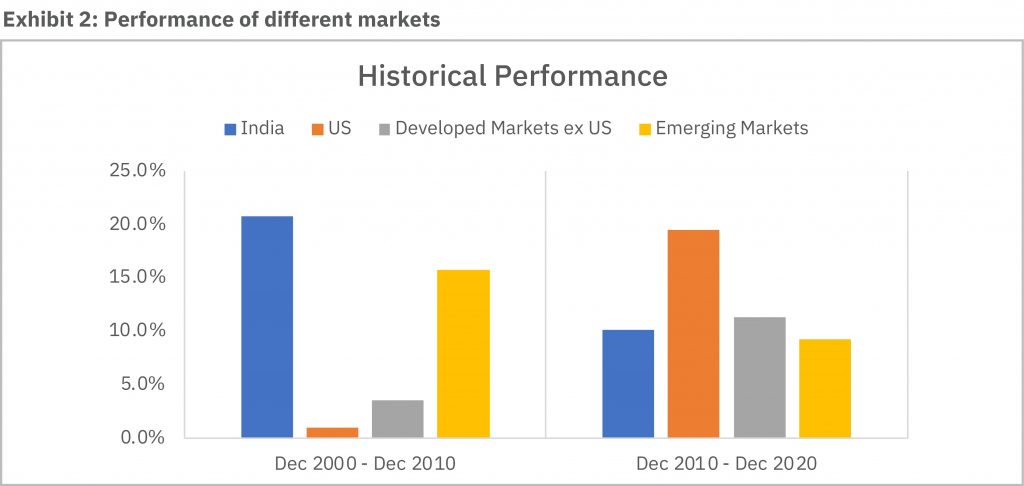

2. Ability to participate in regional rallies –

Investing across geographies enables one to participate in regional rallies. Look at the decade gone-by (2010-2020); the US market outperformed all other regions while the decade before that belonged to Indian equities and the Emerging Markets.

Most Indian investors were late to the party as they started investing in US market funds post 2020 when the US market had already run up significantly.

Now that we have established that international investing helps investors in reducing portfolio risk and also enables them to participate in regional rallies, we are tasked with another question

How much percentage of the portfolio should be allocated to International Equities?

A fundamental question one faces while investing in overseas market is how much proportion of the portfolio should be invested? Theory says as per market capitalization of the region, while Nay-Sayers say 0%.

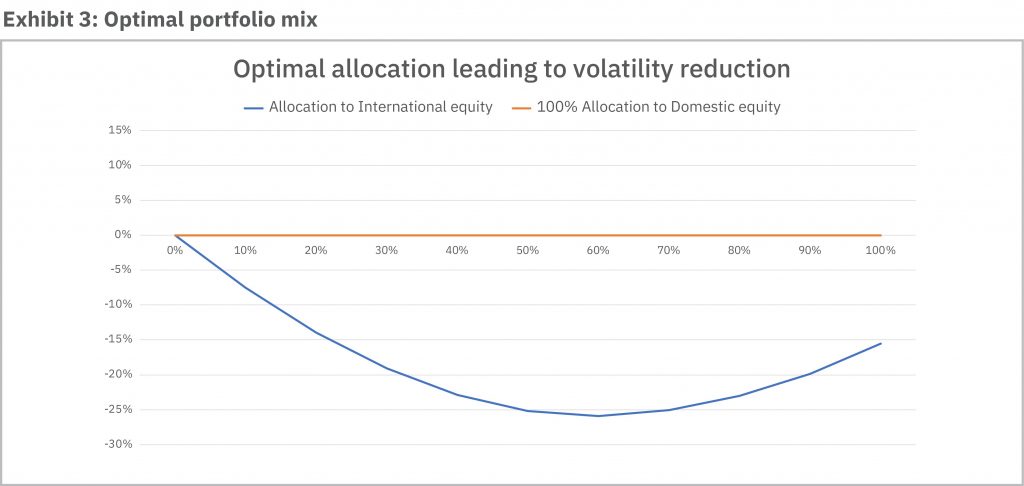

To objectively arrive at a conclusion, let us see how adding exposure to international equities helps in reducing portfolio risk. Exhibit 5 shows the overall portfolio’s risk reduction for every 10% incremental allocation to international equity, with domestic market risk as baseline/starting point (orange line in the chart below).

It is noteworthy to observe that risk continues to decrease with increasing international equity allocation up to a maximum of 50%, at which point any additional allocation results in an increase in overall portfolio risk. According to the research, a 50:50 blend of domestic and international stock may lead to a 25% decrease in volatility when compared to a domestic-only portfolio.

But is a 50% allocation necessary to reap the benefits of risk mitigation?

As per our study, investors can reduce volatility by maximum of ~25% which happens at a 50% allocation. Let’s attempt to determine how much of this maximum volatility reduction can be accomplished with an allocation lower than 50%.

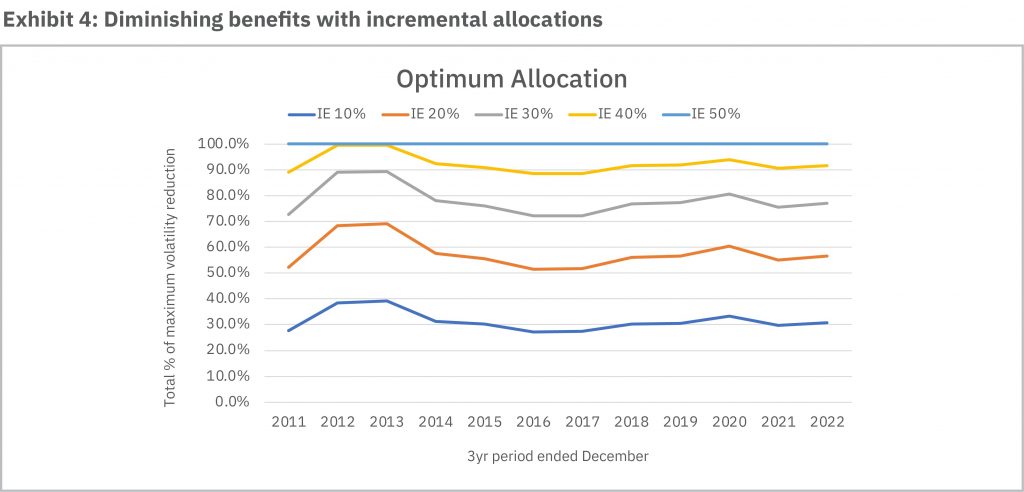

The chart above shows the proportion of maximum volatility reduction achieved with every 10% allocation to International Equity.

From the chart, we noted that

- 10% allocation achieves 30-40% of overall target volatility reduction

- 20% allocation achieves 50-60% of overall target volatility reduction

- 30% allocation achieves 70-80% of overall target volatility reduction

- 40% allocation achieves ~90% of overall target volatility reduction

It is interesting to note that although incremental allocation helps to reduce volatility, it does so at a diminishing rate with every incremental allocation. Considering the above factors, allocating 10% can be a good starting point, while 20-30% allocation seems reasonable. An investor may also consider allocating 40% depending on his risk profile.

Conclusion

A domestic-only portfolio hinges on the expectation that the domestic market will do better than global markets, which may be a risky bet. A geographically diversified portfolio enables an investor to participate in regional rallies but, more importantly, helps reduce volatility in the long term. Additionally, it helps broaden the opportunity set available to investors and protect the portfolio from country-specific risk. In conclusion, allocating a portion of your investment portfolio to international equities can provide diversification benefits and help manage risk. A general guideline is to allocate between 20-30% of your portfolio to international equities. However, it’s important to remember that no one-size-fits-all approach exists, and the right allocation for each investor may be different.

Disclaimer: This article has been issued on the basis of internal data, publicly available information and other sources believed to be reliable. The information contained in this document is for general purposes only and not a complete disclosure of every material fact. The Stocks/sector/countries mentioned herein is for explaining the concept and shall not be construed as an investment advice to any party. The information / data herein alone is not sufficient and shouldn’t be used for the development or implementation of an investment strategy. It should not be construed as investment advice to any party. All opinions, figures, estimates and data included in this article are as on date. Performance results have many inherent limitations and no representation is being made that any investor will, or is likely to achieve. Past performance may or may not be sustained in future. The article does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on our current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Readers shall be fully responsible/liable for any decision taken on the basis of this article. Mutual Fund investments are subject to market risks, read all scheme related documents carefully.