Russian invasion into the soil of Ukraine pushed crude prices to a new high, which was most likely due to markets pricing in Russian supply disruptions into Europe. This acts as fuel to already hot inflation in the region. From an Indian context, the fear of the ongoing war between Russia and Ukraine can be felt in the stock market. India’s dependence for imported petroleum has indeed increased over the years. For instance, in 1998-99, net imports of petroleum products were 69% of total consumption, increasing to around 95% [1] in 2020-21.

Between 1998-99 and 2019-20, India’s GDP grew more than tenfold, while total crude oil imports (in volume) increased only by a factor of 5.5[2]. GDP grew twice as fast as crude oil imports. The driver of this less energy-intensive growth in GDP is the nature of India’s economy. Its economic growth has majorly come on the back of the services sector (56.59% [3] of 2020-21 GVA (PE)), which is less energy-consuming.

Stock Markets Indifference

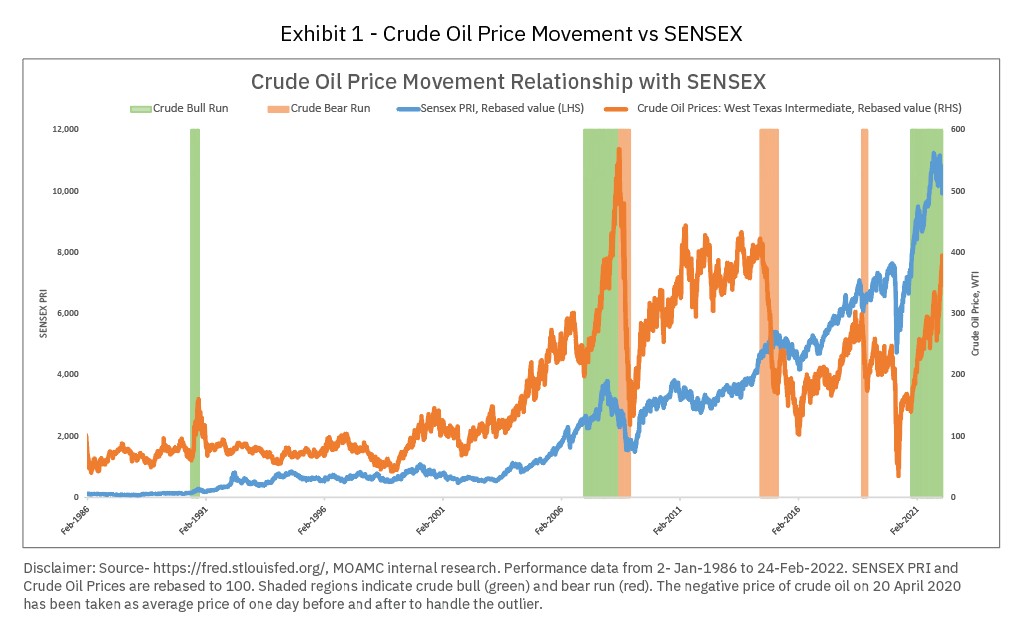

To further examine the relationship between crude oil price movement with the stock market, we looked at the correlation between crude oil and the stock market. Surprisingly, it was merely 4%, which hardly implies any relationship.

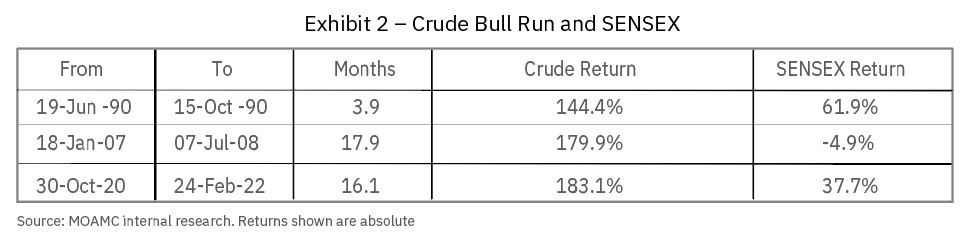

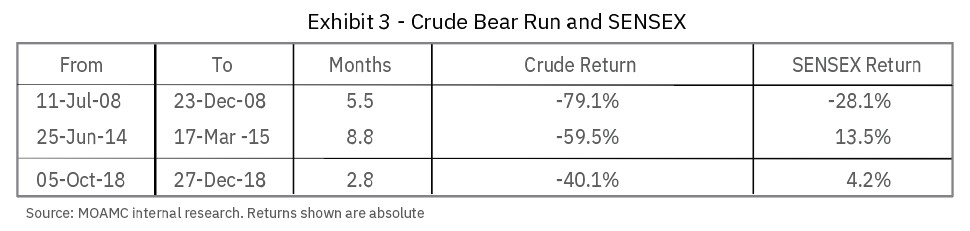

We also performed a time-series study to determine when crude oil rallied and nosedived. Then, we tabulated the stock market returns during the periods identified as follows:

Historically, stock markets have generated negative returns only once in a crude bull run, which probably is an anomaly because the housing bubble (Global Financial Crisis in 2008) had burst by then. Moreover, negative stock market returns had little to do with hot crude prices. Before GFC, crude was in a secular uptrend. It had already rallied 425% from 17 Jan 2002 to 9 Jan 2008, with the stock market delivering 514% in the same period.

Similarly, a bear run in crude does not necessarily imply phenomenal outperformance or negative stock market returns. Only once in recorded history, we find the stock market generating negative returns when crude prices nosedived because it coincided with GFC yet again. In all other instances, the stock market generated positive returns in single and lower double digits, contrary to the widespread belief that a bear run in crude oil prices will stoke the stock markets higher.

Conclusion

The nature of the economy is shifting albeit glacially, and growth is more robust in the low energy-intensive sector of the economy, which insulates the Indian economy against recession. At the same time, consumers and businesses such as truck fleet owners, who have high fuel expenses, will be hit by higher costs. However, a long term investor need not worry about the crude oil cycles. There are many other benefits attached with long term equity investing, know about them in our next blog.

Disclaimer: This article has been issued based on internal data, publicly available information and other sources believed to be reliable. The information contained in this document is for general purposes only and not a complete disclosure of every material fact. The stocks/sectors mentioned herein explain the concept and shall not be construed as investment advice to any party. The information/data alone is insufficient and should not be used to develop or implement any investment strategy. It should not be construed as investment advice to any party. All opinions, figures, estimates and data included in this article are as of date. The article does not warrant the completeness or accuracy of the information. It disclaims all liabilities, losses and damages arising out of the use of this information. The statements contained herein may include statements of future expectations and other forward-looking statements based on our current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Readers shall be fully responsible/liable for any decision taken based on this article. Mutual Fund Investments are subject to market risks; read all scheme related documents carefully