Gone are the days when the market used to speculate if FED was going to even consider a rate hike; I am referring to pre-pandemic times when inflation hovered around 2% (long-term inflation target).

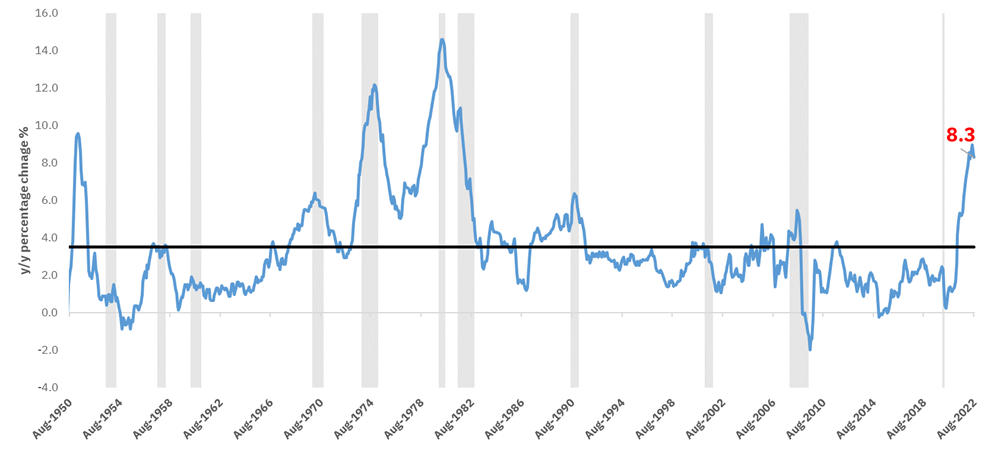

Given the sticky inflation, geo-political risks and the previous rate actions, the market was closely watching the August inflation numbers. Although the inflation number trended downwards, it came in at 8.3% tad above the market expectation. For a brief period markets were factoring in a probability of 100bps rate hike.

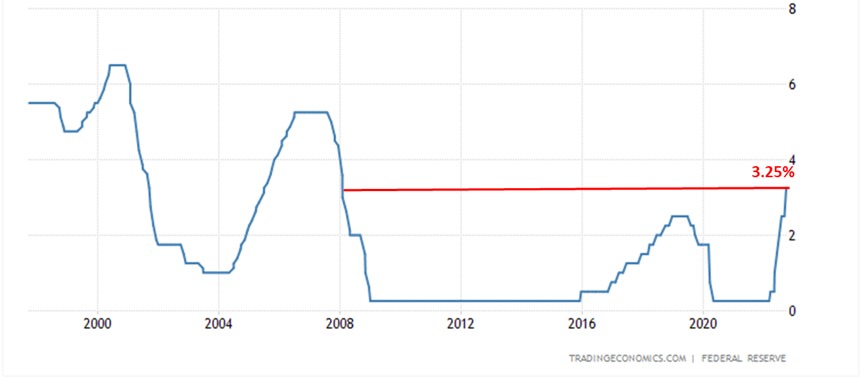

On the 22nd September the FED announced a rate hike of 75bps, the third straight three-quarter point increase and pushed Fed fund rate to 3.25%, highest since 2008. This sent the market tumbling: the bellwether index the S&P 500 fell -1.7%, taking it down by -21% Year to date basis.

Exhibit-1- CPI inflation (y/y change %)

Source: US BLS; as of 31/08/2022

Exhibit-2- FED fund rate after 22nd Sep hike

Romanticizing the past

During the recent annual Jackson Hole conference Fed chairman Mr.Powell, made it clear that FED would accept a recession as a price to tame down high inflation. His words ‘We must keep at it until the job is done’ rekindled the ghosts of the past.

Three consecutive, high-magnitude rate hikes are unheard of, and even baby boomers would struggle to relate as the only period when the FED embarked on such a voyage was during the Paul Volcker era (the 1980s). The then Fed chairman Mr. Paul Volcker drove the US economy into a painful recession on the back of consecutive rate hikes. Even the unemployment rate touched 11% but eventually he managed to tame down the double-digit inflation and achieve price stability.

If one had to draw parallels, the US economy may go in recession in near future.

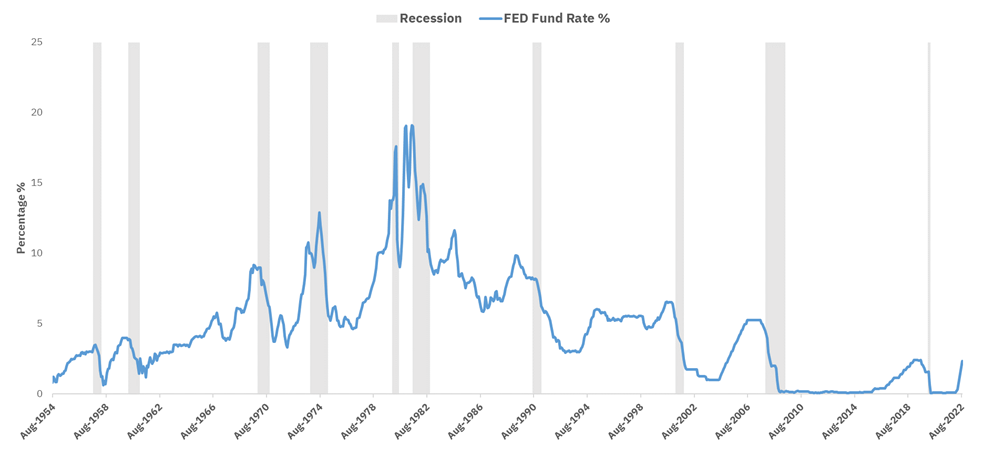

Looking into history

In the past 67 years whenever the FED has embarked on an interest rate tightening cycle, the US economy has fallen into a recession, as evident in the accompanying chart.

Exhibit-3- FED fund rate and Recession

Source: US BLS; as of 31/08/2022

Markets on the edge

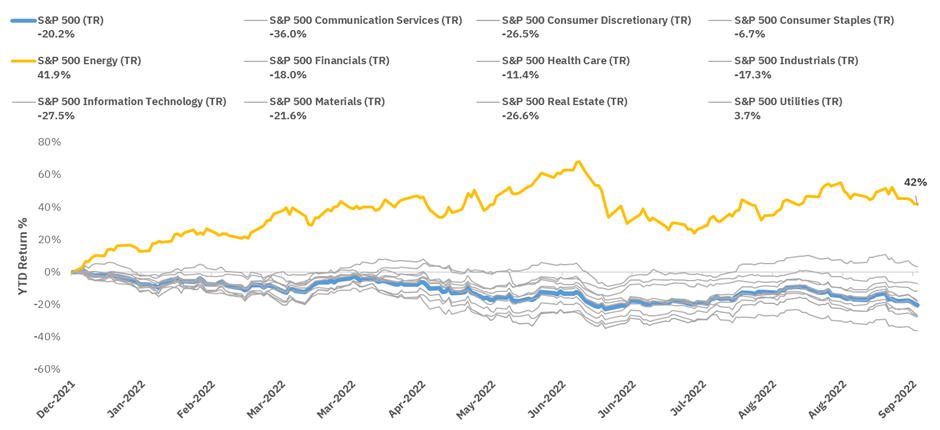

The markets have been on the edge since the start of the year. All sectors, except the energy sector have been under pressure. Rising oil prices have helped the energy sector stay upbeat.

Exhibit-4- Sector-wise YTD returns %

Source: S&P 500; as of 21/09/2022

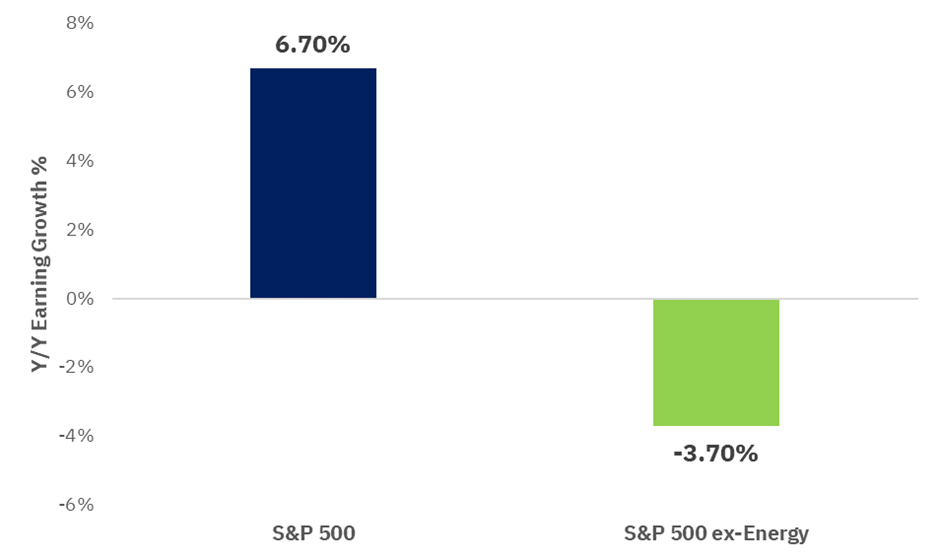

Even on the earnings front, businesses have been reeling under immense pressure. The same is evident in falling earnings for Q2 2022. From a birds eye view, the S&P 500 noted a healthy earnings growth of 6.7% but if one excludes energy sector, the earnings fall to -3.7%. The energy sector’s contribution is hinged on the +293% increase in earnings due to the rise in oil prices over the last year.

Exhibit-5- Q2 2022, S&P 500 Earnings Growth: Ex- Energy

Source- Factset; as of 11/08/2022

Way Forward

Taming the inflation is of prime importance and the aggressive rate action might be deemed necessary. The markets assumes that the terminal rate would reach 4.4% by December 2022 (pricing in greater than ~1% hike in November and December).

Chairman Powell reinforced the committee’s stance during the conference-

“We have got to get inflation behind us. I wish there were a painless way to do that. There isn’t”.

However, the committee said that it would not shy away from changing the stance of monetary policy if risks emerge that could impede the attainment of goals.

Disclaimer: This article has been issued based on internal data, publicly available information and other sources believed to be reliable. The information contained in this document is for general purposes only and not a complete disclosure of every material fact. The indices mentioned herein are for explaining the concept and shall not be construed as investment advice to any party. The information/data herein alone is not sufficient and should not be used for the development or implementation of any investment strategy. It should not be construed as investment advice to any party. All opinions, figures, estimates and data included in this article are as of date. The article does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on our current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Readers shall be fully responsible/liable for any decision taken based on this article. Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.