Dear Investor

In this monthly outlook we shall look at the following:

- Q4FY23 Results Season

- Macro situation is getting better though growth could slow down

- Time for alpha and how we are positioned for it

- Valuations

Q4 Results season

The ongoing result season has been more or less as per expectations with NIFTY Sales, EBIDTA and PAT registering a growth of 14%, 13% and 17%, a tad better than expectations for 42 companies which have declared results till 22st May. Broader universe saw a PAT growth of 19% indicating good breadth of earnings. Metals have been a drag and excluding metals, broader coverage universe EPS growth has been 33%. BFSI and Autos led the earnings growth. Excluding BFSI, earnings has been just 8%. Larger software companies saw downgrades. We continue to expect FY23 EPS to be around 812 levels and FY24 EPS to be between 950 and 1000 for NIFTY.

Macro situation is getting better though growth could slow down

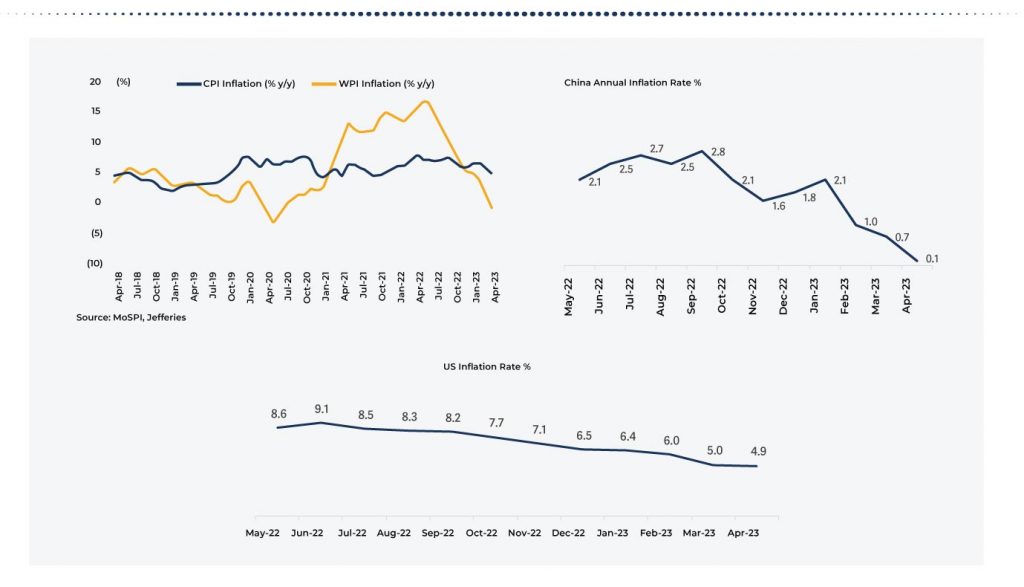

We keep tracking forex reserves as high and improving level of reserves point to improving domestic liquidity and more policy independence. RBI has stopped increasing rates as our forex has climbed and import cover has improved. At the same time trade deficit is narrowing and current account deficit is also expected to narrow. WPI Inflation has been reducing consistently and is now in negative territory. China’s annual inflation rate has also declined and unexpectedly came in at 0.7% in March 2023. This points to improved prospects of US inflation rate to also continue to decline as China is the factory for the world. Reduced inflationary pressures would increase the case for a drop in interest rates. A drop in interest rates would be good for prospects of risk assets like equities and within equities strongly growing businesses with a large terminal value such as new tech benefits the most.

Source: MOSPI, Jefferies

FY24 is a year when the economic growth is expected to slow-down both in real and nominal terms. With growth in money supply reducing globally, global growth should stay below potential. Indian export growth is already showing a decline. Another factor is that now economy’s bounce from Covid low has ended and growth rates are normalizing. 3-month growth indicators in most spaces are mostly flat.

Time for alpha

We believe as the low base effect wears out businesses which are able to grow strongly would start to command a premium in the market. In the last month write-up, we had shared a view that as we go forward and growth becomes less omni-present, the high quality growth style of investing should start to get very competitive vs the value style of investing. We believe following spaces should be able to generate a significant growth alpha over the index growth and the reasons for the same:

- Faster growing retail oriented private banks: FY23 was a year of 15% nominal growth of GDP. FY24 is expected to be just about 10.5% (budgetary assumption). This implies that the system lending growth which would be required to fuel this growth would also be lower. Lower inflation would mean corporate working capital focused banks would find it more difficult to grow. For banks focused on retail, however, it should prove to be business as usual and they could deliver stronger growth.

- New age tech businesses: These businesses have now built up their brand recall and have a significant number of clients. Most are now more focused on profits vs market penetration. The reduction in losses in many of these businesses have been very sharp and it is quite clear that it would sustain over a period of time.

- Hospital infrastructure: There are two drivers for this space. 1) India is rapidly greying and age cohorts of over 60 are seeing sharpest growth in numbers. This is the age when health requirements increase and the people have the ability to pay through savings and through health insurance. 2) after Covid, health tourism is now starting to increase and normalize as patients are again travelling to benefit from low cost Indian health services.

- Premium discretionary spaces: Once again the premium end of the market gets less impacted in an economic slowdown. Categories like Jewellery, weddings and office wear (on re-opening) should prove to be resilient.

- Engineering and defence Capex: Make in India continues to be a big focus of the government. Recently another list of defence products for domestic manufacturing was brought out. India continues to endeavour to build new age manufacturing expertise. Companies with technologies to help India achieve its dreams have a good chance of continuing to show strong order book growth. Government was the sole driver of capex earlier but now private sector is also beginning to participate. Debt to Equity ratio of large listed companies has fallen sharply over 2016 to now and is expected to continue to fall. Banks are in good health as well. Housing, the other big driver of capex, is also seeing an upswing.

- China -1: The world now wants to de-risk away from China. Earlier countries wanted to have another supply source apart from China but now increasingly the sentiment is that we would source from anywhere but China. Many businesses are benefiting on this count. Government of India has rolled out PLI schemes across the board and many companies have come up in the EMS space. Chemicals are a big beneficiary of this move across the world. Listed companies are increasingly looking at new growth areas such as Li Battery manufacturing, solar cell manufacturing, hydrogen electrolysers, EVs, etc.

- Mid-sized IT companies focussed on growth verticals: Q4 has been mixed for IT companies. Many large IT companies have seen issues in BFSI and discretionary spends. However, smaller companies focussed on growth verticals have done relatively better. This trend could continue as verticals like airlines and hotels benefit from travel reflation, auto vertical benefits from upgrade to EV and connected cars, telecom vertical expected to benefit from 4G to 5G transition. Europe which was behind the US in outsourcing is now joining the bandwagon and larger midcap IT companies benefit from having crossed the size threshold and are benefiting from qualifying for increase in larger deals. Many companies have seen credible changes in top management.

Our portfolios, focused on the QGLP philosophy, across the board have a fair representation of the above growth spaces. If the thesis plays out right in terms of growth premium being accorded to spaces where growth sustains at higher levels, then our funds should be able to deliver significant alpha. High quality combined with sustainable higher than economy growth is what we are seeking. We believe that with gross fixed capital formation reversing the downward trend and with Private final consumption peaking out, beneficiaries of capex theme with pricing power could benefit over consumption theme. FMCG (ex ITC) had seen its PE expand from 20x in 2006 period to around 50x now. Consumer discretionary, similarly, had seen PE expand from 20x to 70x, over the same period. With the earnings spread now more broad based, vs the narrowing earnings that we saw in the 2012 to 2020 period, we do believe that the consumption space can see some price consolidation while other spaces, as highlighted above, take the performance baton.

Valuations

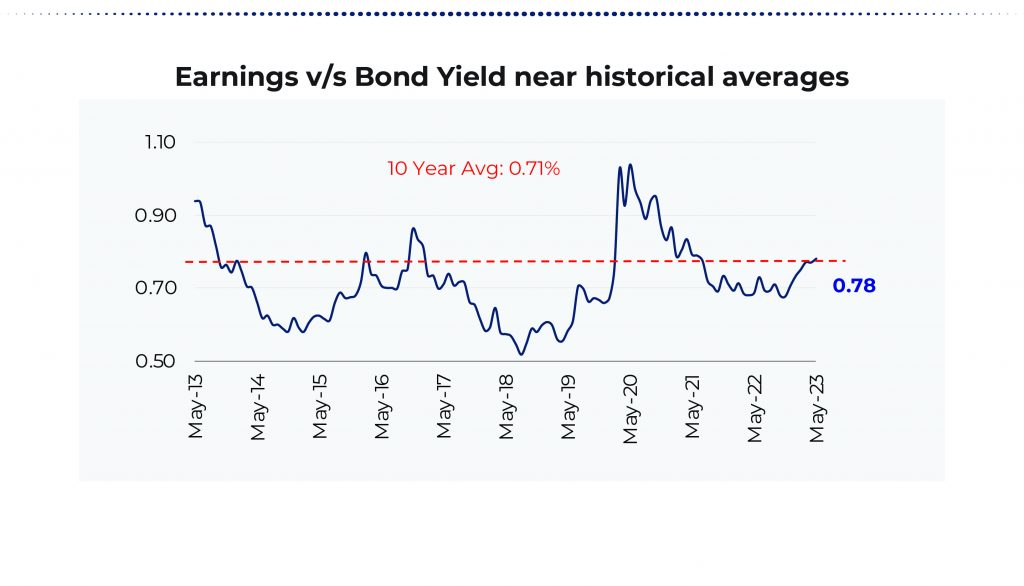

Markets have moved up over the past month and are again over 18,200 levels. As we have been explaining previously, our fair valuation construct is 18-18.5x one year ahead EPS for the NIFTY. Given that FY24 Nifty is expected to have an EPS of between 950 and 1000, we continue to believe that the valuations are fair. Markets should hence be expected to track earnings growth expectations going forward.

Moreover, when we compare equity with debt, with debt yields falling, equities have become competitive vs debt on a pre-tax basis. With debt returns now being taxed on marginal income of investors, equity has become more competitive vs debt on post tax basis.

Source: MOIE

Foreign yields are still high and we expect foreigners to continue to be debt focused and hence flows into EMs could be low. In the past period though, India saw strong inflows maybe on account of move away from China.

In the coming period, there is an expectation that Korea may be designated as a developed market in MSCI indices. If this happens, India would be a large beneficiary. Even otherwise, we expect some passive inflows into India as some large banks becomes part of MSCI.

Thank You

Happy Investing

Best Regards,

Prateek Agrawal

Executive Director – Motilal Oswal Asset Management Company Limited

Disclaimer: This article has been issued on the basis of internal data, publicly available information and other sources believed to be reliable. The information contained in this document is for general purposes only and not a complete disclosure of every material fact. The Stocks mentioned herein is for explaining the concept and shall not be construed as an investment advice to any party. The information / data herein alone is not sufficient and shouldn’t be used for the development or implementation of an investment strategy. It should not be construed as investment advice to any party. All opinions, figures, estimates and data included in this article are as on date. The article does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on our current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Readers shall be fully responsible/liable for any decision taken on the basis of this article. Investments in securities market are subject to market risks, read all relevant documents carefully. Mutual Fund investments are subject to market risks, read all scheme related documents carefully.