What should you expect from your portfolio when inflation peaks out?

Trying to predict when inflation will peak is a lot like trekking. In both cases, the peak is only visible when we zoom out & look from a distance. While in the middle of the climb, we frequently believe we have achieved the peak, only to discover that another peak is concealed behind it. It is only after the arduous climb that we realise we have reached the peak.

Like trekking, the journey towards the peak of inflation is usually painfully excruciating. Elevated inflation levels translate into higher costs of production & cost of borrowing, which impact corporate earnings & consumer spending, respectively. Similar to trekking, hindsight is the only way to identify the peak.

Have we reached the peak yet?

There are many factors to consider while determining whether inflation has peaked. While there are visible signs of a downward trend, the critical question is whether the fall in inflation will be sustainable. Early signs of falling food inflation and a fall in the prices of commodities, including crude oil, provide hope.

RBI had hinted in its November bulletin that inflation might have reached its upper limit & is set to ease going forward. Various market analysts also believe that inflation has peaked & November’s CPI data at 5.9% provide relief.

How do different asset classes historically perform post-peak inflation?

The performance of any asset class is influenced by a multitude of factors, the expectation of future inflation being one of them. Currently, we are witnessing very high inflation globally, which has investors on the edge. Therefore, we have tried to analyse how each asset class has performed historically before and after peak inflation.

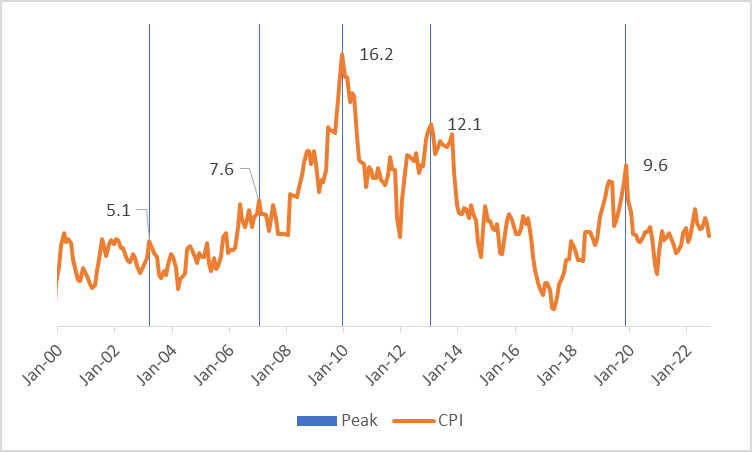

Identifying Peak Inflation

With the benefit of hindsight, we tried to identify historical inflation peaks. For the analysis, if the CPI for a particular month is higher than the 12-month before and subsequent 12-month period, we have considered that inflation has peaked. Since 2000, we get four such instances, excluding the peak of May 2003 (when inflation was within the RBI’s threshold).

Exhibit 1: Historical (CPI) Inflation Peaks in India

Source: Inflationtool. Data as of 31-Dec-1999 to 31-Oct-2022

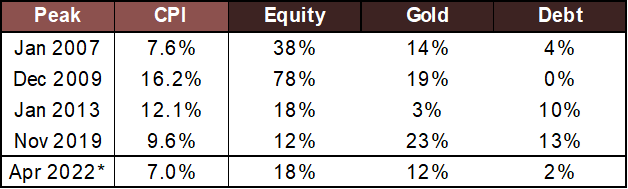

Performance up to inflation peak:

Historically, equity & gold noted impressive returns in all instances except in 2013, when gold gave low returns on account of the strengthening dollar. Debt is impacted by Interest rates that generally trend upwards during rising inflation, except in 2013 & 2019 when interest rates started falling.

In 2022, equities and gold continued their strong performance leading up to the inflation peak.

Exhibit 2: 12-month returns up to the Inflation peak

Equity = Nifty 50 TR Index

Debt = Nifty 5 yr Benchmark G-Sec Index

Source/Disclaimer: niftyindices, Gold – Factset/ICICI; total returns index (TRI) used for performance calculations. Data as of close of 31-Jan-06 to 30-Apr-22. Past performance may or may not be sustained in future.

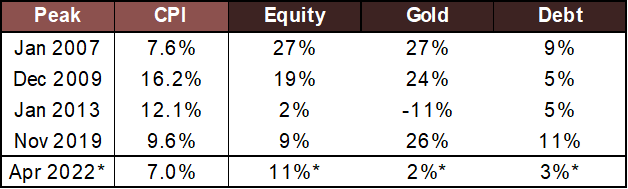

Performance after inflation has peaked:

Since it is difficult to identify when inflation will peak in real-time, the effects of inflation generally come with a lag. High inflation causes a rise in raw material costs that impact company earnings & eventually, equity returns. Thus, equity returns have been relatively low post-peak inflation. Even gold rises higher due to its perception of an inflation hedge (except in 2013 on account of USD appreciation). Similarly, delayed central bank response to high inflation by way of rate hikes causes debt to do only slightly better than before Inflation peaks.

Similarly, in 2022, high input costs & continued steep rate hikes explain the lower returns for equity & debt, while a strengthening USD explains the low returns for gold.

Exhibit 3: 12-month returns from the peak of Inflation

Equity = Nifty 50 TR Index

Debt = Nifty 5 yr Benchmark G-Sec Index

Source/Disclaimer: niftyindices, Gold – Factset/ICICI; total returns index (TRI) used for performance calculations. *Forward-looking data considered till November 2022. Data as of close of 31-Jan-06 to 30-Nov-22. Past performance may or may not be sustained in future

As hikers continuously ask their tour guide every 10 minutes,

“How much more to go?”

Guide: 5 more minutes!

“Will we get a good view?”

Guide: Unless the weather gods have some other plan!

Similarly, inflation peaking out has historically fared well for gold and debt, provided the absence of USD strengthening & steep rate hikes.

Disclaimer: This article has been issued based on internal data, publicly available information and other sources believed to be reliable. The information contained in this document is for general purposes only and not a complete disclosure of every material fact. The indices mentioned herein are for explaining the concept and shall not be construed as investment advice to any party. The information/data/graph herein alone is not sufficient and should not be used for the development or implementation of any investment strategy. It should not be construed as investment advice to any party. All opinions, figures, estimates and data included in this article are as of date. The article does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on our current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Readers shall be fully responsible/liable for any decision taken based on this article. Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.

This article was covered by The Economic Times on 21st January 2023

How various asset classes perform during inflationary periods – The Economic Times (indiatimes.com)