Financial markets around the world have had a rough start in 2022. Equity indices are tumbling from all-time highs and bond yields continue to trend upwards. Central Banks have begun raising rates and are tightening the supply of “easy money” to combat the woes of rampant inflation. The Russia-Ukraine conflict and lock down across major cities in China continue to cause supply-chain disruptions and have only added fuel to the fire. The stock markets in India have seen heightened volatility as well which has made investors uneasy after a tremendous bull run over the last ~2 years.

VIX – the “fear gauge” of the market

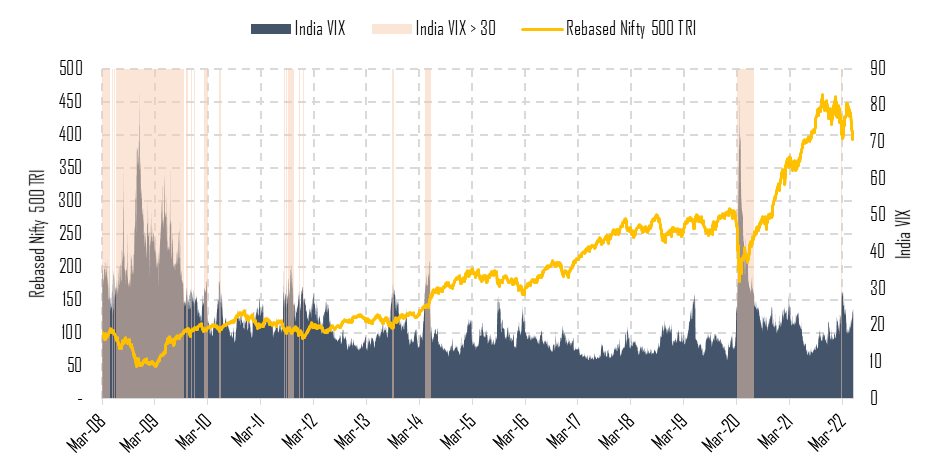

The India VIX – popularly known as the “fear gauge” of the Indian stock market – is a measure of the expected volatility of market in the near future. A high level of VIX indicates more uncertainty (or fear) in the market while a low level of VIX indicates less uncertainty. It breached the level of 30 on 24-Feb-2022 for the first time in nearly 2 years, signaling that investors were the most “fearful” since the Covid-19 pandemic. India VIX has since averaged 22.4, staying significantly above its long-term median value of 18.3.

Exhibit 1 – India VIX breaches level of 30 after nearly 2 years

Source/Disclaimer: investing.com, niftyindices.com, MOAMC Research. Performance as of close of 04-Mar-08 to 17-May-22.

Historical data going back to 2008 suggests that the markets become increasingly turbulent whenever VIX spikes over 30 (~87th percentile). At first glance, it may seem rational to be fearful in such situations. However, data shows that the equity markets tend to bounce back quickly after periods of heightened volatility.

Equity markets bounce back quickly

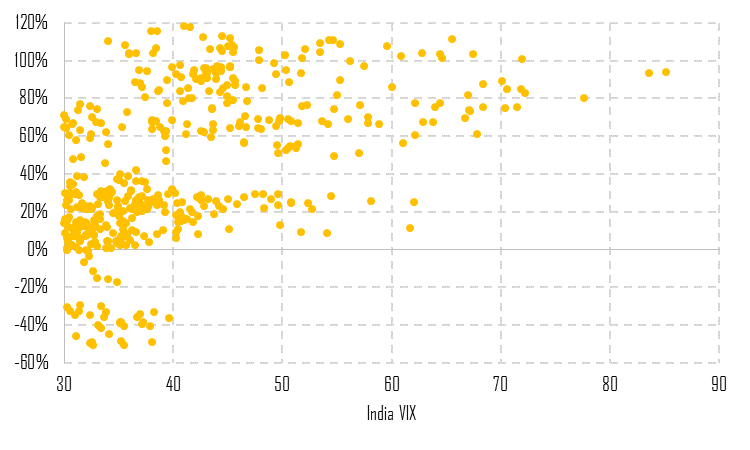

To better understand this, we looked at how Nifty 500 TRI performed over the next 12 Months when India VIX was above the level of 30. There were 468 such trading days over the last 14+ years, and in 428 of these occasions (91%), the Nifty 500 TRI delivered positive returns over the next 12 months. It tells us that even though the equity market may be plagued with uncertainty in turbulent times such as this, they tend to bounce back quickly. The scatter plot below provides a visual representation of this information where we can clearly see the vast majority of 12-month forward returns being greater than 0%.

Exhibit 2 – 12-month forward returns when India VIX breaches level of 30

Source/Disclaimer: investing.com, niftyindices.com, MOAMC Research. Performance as of close of 04-Mar-08 to 17-May-22.

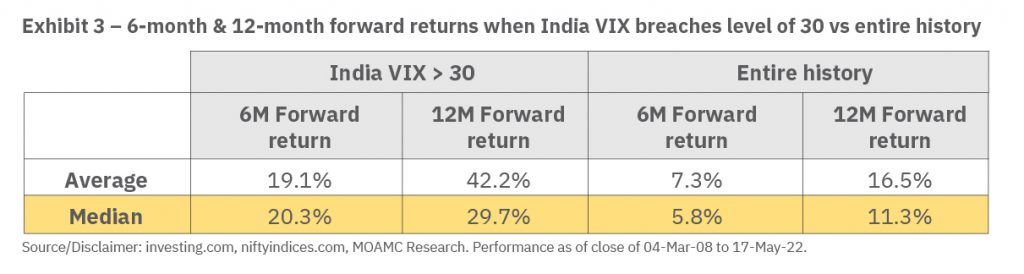

To get a clearer picture, we compared the 6-month and 12-month forward returns during these highly volatile days (India VIX > 30) with the rolling returns over the entire history available.

Looking at the median values, which eliminate the impact of outliers, we can see that the Nifty 500 TRI has historically delivered over 3x higher returns over the next 6-months whenever India VIX spiked above 30. Similar inference can be drawn from the 12-month forward returns, which show more than 2x higher returns when VIX hit above 30.

Conclusion

Investors need not panic and give-in to the fear in volatile markets. History shows that equity markets tend to bounce back relatively quickly after periods of heightened volatility. Therefore, investors may benefit from focusing on “finding calm in the midst of chaos” and sticking with their long term investing in their journey of wealth creation.

Author: Raghav Avasthi, Research Analyst, Passive Funds, Motilal Oswal AMC

Co-author: Mahavir Kaswa, Head of Research, Passive Funds, Motilal Oswal AMC

This blog was also featured in Financial Express

Disclaimer: This article has been issued on the basis of internal data, publicly available information and other sources believed to be reliable. The information contained in this document is for general purposes only and not a complete disclosure of every material fact. The indices mentioned herein is for explaining the concept and shall not be construed as an investment advice to any party. The information / data herein alone is not sufficient and should not be used for the development or implementation of any investment strategy. It should not be construed as an investment advice to any party. All opinions, figures, estimates and data included in this article are as on date. The article does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on our current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Readers shall be fully responsible/liable for any decision taken on the basis of this article. Mutual Fund investments are subject to market risks, read all scheme related documents carefully.