The widespread popularity of factor-based investing across the globe has evolved from academia to institutional as well as retail investors with the advent of rules based ETFs and Index Funds based on these strategies. Though initially limited to academic research, factors have become popular over the recent years from an investment perspective. The reason to this is quite simple. Factors work in practice.

Although dozens of market anomalies have been reported in the academic literature, investors normally should stick to factors that have been thoroughly tested in practice such as Quality, Low Volatility, Momentum and Value. These factors are proven, investable, robust, explainable and their performance has been persistent even after the publication of these factors.

Over the years, there has been extensive evidence to the fact that strategies that exploit these factors add significant long-term value for investors, help reduce portfolio risk, improve risk-adjusted returns and boost diversification.1 And here-in lies the downside to blindly look at the benefits of factor investing: not fully understanding the risks and shortcomings of factors and making suboptimal allocation decisions.

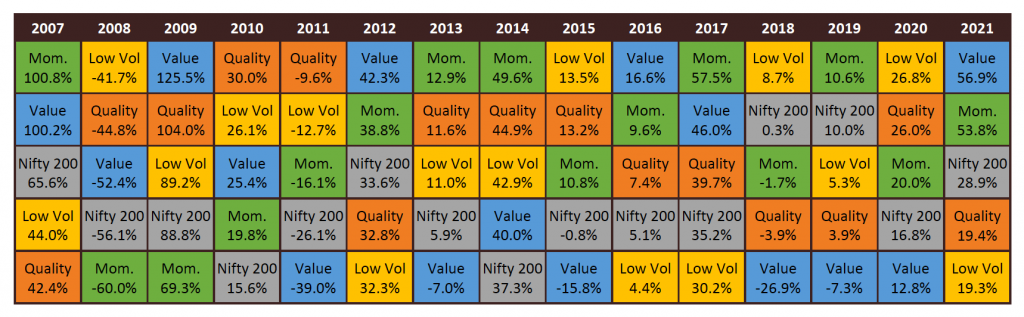

Factors have risks and ignoring these risks can leave investors underprepared as far as their investments are concerned. Investors, for e.g., can form exaggerated expectations about performance of a particular factor as a result of past returns and hence can ignore the fact that factor returns tend to be cyclical. They tend to perform differently in various economic and market regimes. As can be seen in the quilt below, each of the factors underperform the broader market over a certain period of time. This can lead to poor allocation choices with regards to entering / exiting a particular factor in the short term as it is prone to timing risk.

Legend: Value – S&P BSE Enhanced Value TRI, Low Vol – S&P BSE Low Volatility TRI, Mom. – Nifty 200 Momentum 30 TRI, Quality – S&P BSE Quality TRI & Nifty 200 – Nifty 200 TRI

Source/Disclaimer: niftyindices, S&P BSE. Performance as of close of 31-Dec-06 to 31-Dec-21. Performance results have many inherent limitations and no representation is being made that any investor will, or is likely to achieve. Past performance may or may not be sustained in future. The above graph is used to explain the concept and is for illustration purpose only and should not be used for development or implementation of an investment strategy.

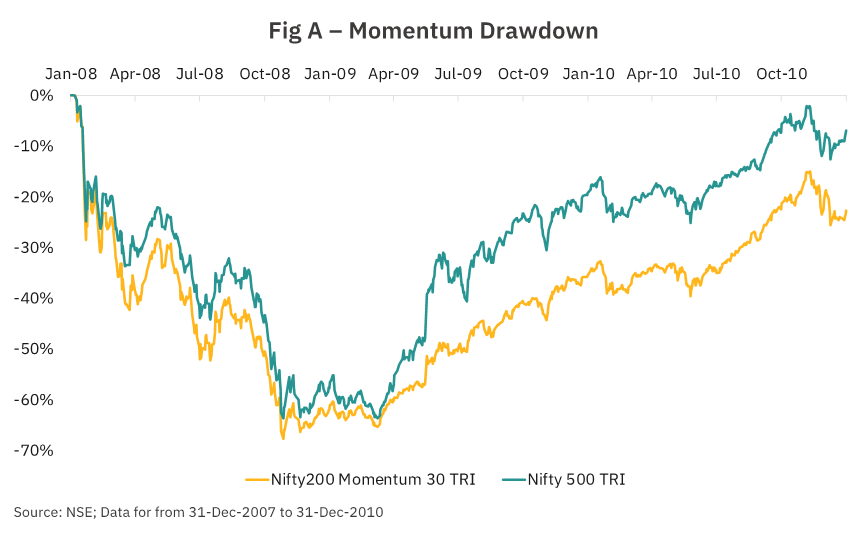

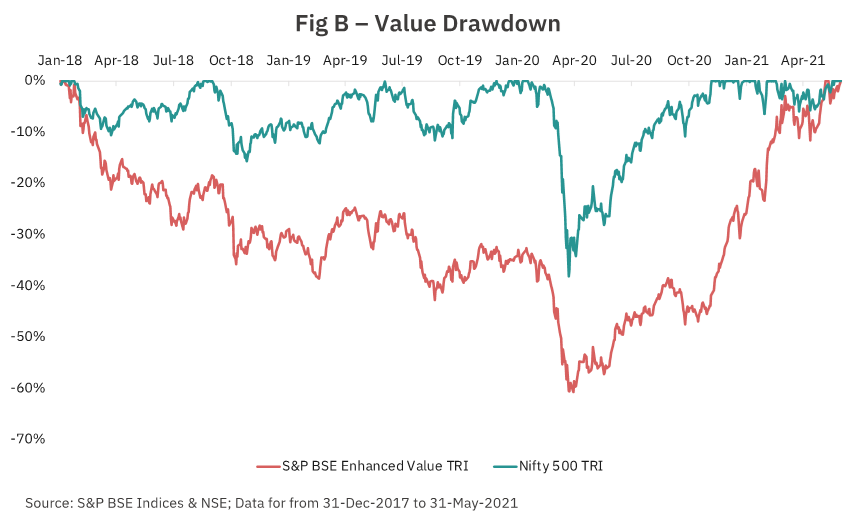

Moreover, Factors can face longer drawdowns or be more volatile over a period of time. To illustrate this point, we take a look at the drawdowns for the Momentum and the Value Factor and Comparing Momentum Drawdown with Nifty 500. Post the global financial crisis, the Momentum Factor took time to recover which led to a longer drawdown period. On the other hand, the Value Factor, witnessed a steeper drawdown post 2018 and took more than 40 months to recover.

Source/Disclaimer: niftyindices; Performance as of close of 31-Dec-07 to 31-Dec-10. Performance results have many inherent limitations and no representation is being made that any investor will, or is likely to achieve. Past performance may or may not be sustained in future. The above graph is used to explain the concept and is for illustration purpose only and should not be used for development or implementation of an investment strateg

Source/Disclaimer: S&P BSE; Performance as of close of 31-Dec-17 to 31-May-21. Performance results have many inherent limitations and no representation is being made that any investor will, or is likely to achieve. Past performance may or may not be sustained in future. The above graph is used to explain the concept and is for illustration purpose only and should not be used for development or implementation of an investment strategy.

Conclusion

Factors can be used constructively in investor portfolios to deliver superior risk-adjusted returns, but until investors are comfortable with the nuances associated with each factor, they may be better suited as a satellite allocation.

1 For eg: E. van Gelderen and J. Huij, ‘Academic Knowledge Dissemination in the Mutual Fund Industry: Can Mutual Funds Successfully Adopt Factor Investing Strategies?’, The Journal of Portfolio Management, 2014.

Disclaimer:This article has been issued on the basis of internal data, publicly available information and other sources believed to be reliable. The information contained in this document is for general purposes only and not a complete disclosure of every material fact. The Stocks mentioned herein is for explaining the concept and shall not be construed as an investment advice to any party. The information / data herein alone is not sufficient and shouldn’t be used for the development or implementation of an investment strategy. It should not be construed as investment advice to any party. All opinions, figures, estimates and data included in this article are as on date. The article does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on our current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Readers shall be fully responsible/liable for any decision taken on the basis of this article. Mutual Fund investments are subject to market risks, read all scheme related documents carefully.