Passive investing has been a flavour of the markets in recent years. Interestingly, it is not restricted just to equities. Even in the bonds market, the idea of passive investing is gaining currency. Broadly the passive bond strategies includes buy and hold (B&H) and constant maturity debt (CMD).

In recent years, the B&H has received wider acceptance from investors. But, at the same time, it is evident that the potential of constant maturity schemes as a category has not been explored and tapped much. So let us understand why constant maturity debt funds can make money for you:

Before we dive into the nuances of the strategy, it’s imperative to understand the relationship between the interest rate (yield) and the bond’s price is akin to a seesaw, with interest rates sitting on one end and the price of a bond on the other end. When the interest rates go up, the prices go down and vice versa. This is termed as interest rate risk. When the duration of a bond’s portfolio—a measure of the bond’s interest rate risk calculated using maturity, coupon and current yield—is high, the interest rate risk is also high, and vice versa.

In the context of these facts, let us understand, How CMD Funds Work?

In the B&H strategy, bonds are held till maturity and coupons are reinvested. As the portfolio ages, the interest rate risk decrease and at maturity, the returns converge to the initial yield. However, in case of the CMD fund, the fund manager buys bonds of pre-determined duration; as duration reduces, portfolios are rebalanced periodically to maintain the target duration. The rationale is to keep duration and interest rate risks constant.

There are two ways to make money for bond fund investors: the coupon received by bonds held in the portfolio and the capital appreciation/loss incurred on bonds.

CMD investors tend to be worried during rising interest rates since the fund may incur capital losses as bond prices fall. However, this is a half-truth, especially if an investor is keen to stay put. The scheme registers capital losses as yields rise; however, new bonds with higher coupons are typically included in the portfolio as these funds rebalance periodically. This results in increased coupon accrual. Though investors incur capital losses in the short term, higher coupon accruals offset these capital losses in the long term.

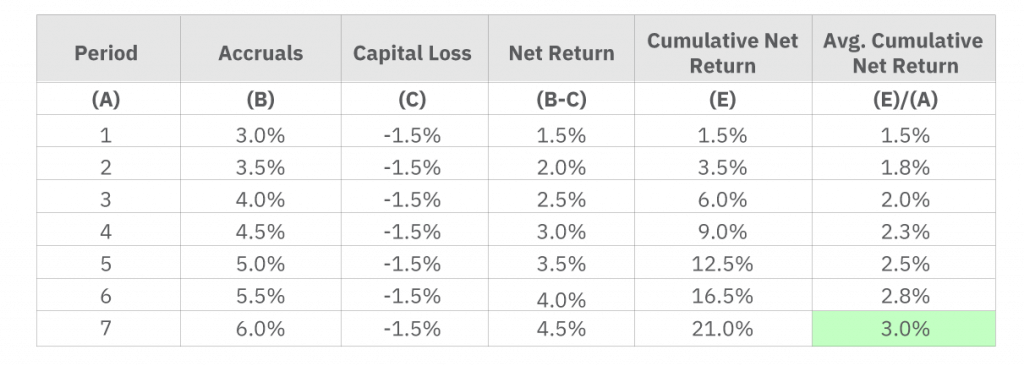

Consider a single-bond portfolio to understand how this works out (see illustration below). The bond offers a 3% coupon to start with, and interest rates are assumed to increase by 0.5% (50 basis points) annually. The duration of a bond, in the beginning, is considered to be four years, and it is sold when the bond’s duration falls to three years. This leads to capital loss of approximately -1.5% (i.e. – duration x change in interest rate) at the end of every year. Hence, the net return at the end of year one will be 1.5% (3% coupon accrual minus 1.5% capital loss). The sale proceeds of the bond are used to purchase a new bond with four years duration and which pays a coupon of 3.5%. At the end of the second year, the net return will be 2%.

Illustration: How higher coupons offset capital losses during rising interest rates

Disclaimer- MOAMC research. The above table explains the concept for illustration purposes only and should not be used to develop or implement an investment strategy. Note that the assumptions listed above are central to the illustration.

As accruals rise in later years, the average cumulative return is equivalent to the initial yield at the end of seven years. Loosely speaking, the average returns of CMD converges to the initial yield after ‘2*n-1’ years (where ‘n’ is the target duration, in this illustration, it is four years).

To summarise, as interest rates rise, a CMD fund investor may initially incur some losses. However, over a period of time, increasing coupon accrual will offset the capital losses. The opposite holds true as interest rates fall. Hence, for long term investors, CMD fund is an option worth considering.

Author: Anuj Desai, Research Analyst, Passive Funds, Motilal Oswal AMC

Co-author: Mahavir Kaswa, Head of Research, Passive Funds, Motilal Oswal AMC

The shorter version of this article was covered by Economics times on 25th April 2022 https://economictimes.indiatimes.com/mf/analysis/constant-maturity-debt-funds-gain-in-long-term-whether-rates-rise-or-fall/articleshow/91060544.cms.

Disclaimer: The article has been issued on the basis of internal data, publicly available information and other sources believed to be reliable. The information contained in this document is for general purposes only and not a complete disclosure of every material fact. The information / data herein alone is not sufficient and shouldn’t be used for the development or implementation of an investment strategy. It should not be construed as investment advice to any party. All opinions, figures, estimates and data included in this article are as on date. The article does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on our current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Readers shall be fully responsible/liable for any decision taken on the basis of this article. Mutual Fund investments are subject to market risks, read all scheme related documents carefully.