Over the last 10 years, the Indian equity market has undergone a significant transformation on the back of supportive economic environment and robust regulatory framework. This has led to greater participation from domestic as well as foreign institutional investors. On the other hand, the rise of tech-enabled discount brokers and investment apps has also helped improve retail participation.

Liquidity refers to the ability of a stock to be bought or sold quickly, and with minimal impact on its trading price. If a stock has high liquidity, it means that there are many buyers and sellers looking to trade, and it can be easily bought or sold. On the other hand, a stock with low liquidity may be harder to trade as there may be fewer buyers and sellers, resulting in wider bid-ask spreads and higher impact cost.

In this article we will look at a few measures of liquidity for the top 500 listed companies in India and how they have improved over last 10 years (from 2012 to 2022).

Liquidity has improved sharply over the last 10 years

MOAMC Research, Factset, NSE; Data as of 31-Dec-2012 to 31-Dec-2022. Liquidity defined as Median Daily Traded Value (MDTV). Liquidity calculated for constituents of Nifty 500 Index. Top 100 companies by free float market-cap are defined as Largecap, 101 to 250 as Midcap, and the rest as Smallcap.

The Median Daily Liquidity shown in the chart above represents the value of all shares of a company that were traded on a typical day. The daily liquidity of a typical Largecap stock has grown nearly 5x from ₹38 Crs in 2012 to ₹174 Crs in 2022. Similarly, the daily liquidity of a typical Midcap as well as a Smallcap stock has grown nearly 10x over the last 10 years.

Though the pace of improvement in liquidity has somewhat slowed over the last 5 years for Largecap and Midcaps, liquidity in Smallcaps has continued to grow at a stellar pace. Interestingly, the biggest improvement in liquidity was in the Midcap segment when daily liquidity grew 5x from ₹4 Crs to ₹22 Crs in just 5 years (2012 to 2017).

The biggest takeaway is that investors now have the opportunity to invest and trade in stocks well beyond just the top 100 Largecaps as there is sufficient liquidity even in the Smallcaps.

Free Float Market-cap has grown across the board

MOAMC Research, Factset, NSE; Data as of 31-Dec-2012 to 31-Dec-2022. Top 100 companies by free float market-cap are defined as Largecap, 101 to 250 as Midcap, and the rest as Smallcap.

Free float market-cap measures the value of a company’s shares that are publicly available for trading in the market. It excludes shares held by promoters or other entities with significant control over the company. It provides a more accurate picture of a company’s market value available for public trading and helps assess the liquidity of its stock.

The Free float market-cap of a typical Largecap company has grown nearly 4x from over ₹10,500 Crs in 2012 to over ₹42,000 Crs in 2022. Similarly, the Free Float market-cap of a typical Midcap company has grown 5x, while it has grown nearly 7x for Smallcaps. Interestingly, the average Midcap stock now has the same market-cap of ~₹10,000 Crs as the typical Largecap stock 10 years ago!

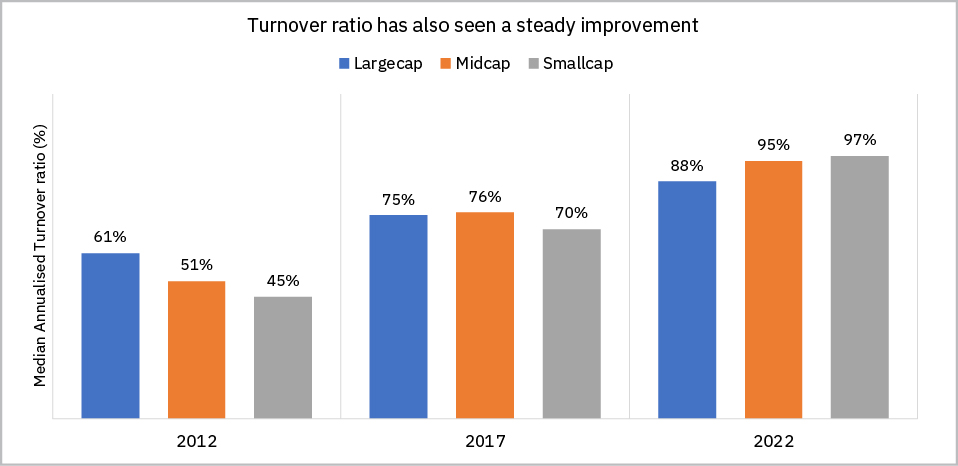

Turnover ratio has also seen a steady improvement

MOAMC Research, Factset, NSE; Data as of 31-Dec-2012 to 31-Dec-2022. Turnover ratio is defined as Annualised Daily Turnover divided by Free Float Market-cap. Top 100 companies by free float market-cap are defined as Largecap, 101 to 250 as Midcap, and the rest as Smallcap.

The turnover ratio is calculated by dividing the total trading value of a stock during a year by the free float market-cap. In simple words, it tells us how frequently a stock is traded in a given year. The higher the turnover ratio, the more actively the stock is being bought and sold, indicating higher liquidity and lower impact cost. It is a relative measure that helps understand the liquidity of stocks in relation to its size, eliminating any biases in nominal liquidity measures that may emerge because of inflation over longer periods of time.

The turnover ratio has steadily improved across the board over the last 10 years, indicating that there is now ample liquidity in all sections of the market. This is a stark improvement from 2012, when the turnover ratio of Smallcaps was below 50% and Midcaps were barely above 50%. The turnover ratio now stands nearly at or above 90% for the typical Largecap, Midcap, and Smallcap stocks.

In conclusion, the Indian stock market has undergone significant changes over the last decade, which have led to an improvement in liquidity across market segments. A robust regulatory framework coupled with supportive economic environment has led to increased participation from domestic and foreign institutional investors. New-age brokers and investment platforms have also helped open the door for many new retail investors as well. As a result, the Indian equity market is a lot more transparent, efficient, and accessible to investors today than it was 10 years ago. This has also resulted in a significant improvement of liquidity in the market, especially beyond the largest blue-chip stocks.

Author: Raghav Avasthi, Research Analyst, Passive Funds, Motilal Oswal AMC

Co-author: Mahavir Kaswa, Head of Research, Passive Funds, Motilal Oswal AMC

This blog was also covered in Economic Times on 19th May 2023, click on the link below to view:

Disclaimer: This article has been issued on the basis of internal data, publicly available information and other sources believed to be reliable. The information contained in this document is for general purposes only and not a complete disclosure of every material fact. The indices/stocks mentioned herein is for explaining the concept and shall not be construed as an investment advice to any party. The graph used above is to explain the concept and is for illustration purpose. The information / data herein alone is not sufficient and should not be used for the development or implementation of any investment strategy. It should not be construed as an investment advice to any party. All opinions, figures, estimates and data included in this article are as on date. The article does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on our current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Readers shall be fully responsible/liable for any decision taken on the basis of this article. The recipient should exercise due caution and/ or seek professional advice before making any decision or entering into any financial obligation based on information, statement or opinion which is expressed herein.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully